Key Highlights

In a statement, Pfizer Inc. stated its coronavirus vaccine prevented more than 90% of infections, sparking sharp moves in the market.

- Gold price declined over $1,000 from the $1,960 resistance area.

- EUR/USD reacted to the downside, as the greenback gained bullish momentum.

- GBP/USD is facing a strong resistance near 1.3200.

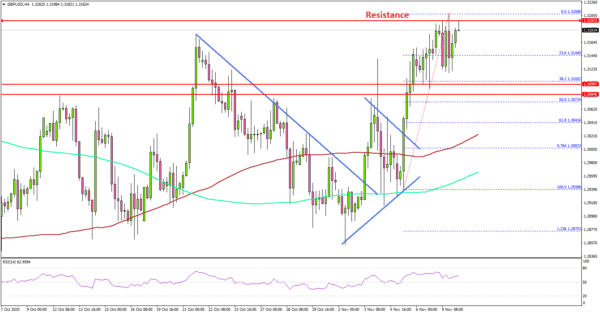

- GBP/USD Technical Analysis

After forming a support base near the 1.2940 level, the British Pound started a fresh increase against the US Dollar. GBP/USD broke the 1.3000 and 1.3120 resistance levels to move into a positive zone.

Looking at the 4-hours chart, the pair gained pace after it broke the 1.3020 resistance and a contracting triangle. There was a sharp rise above 1.3100, and a close above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

However, the pair seems to be facing a strong resistance near the 1.3200 level. A successful break and close above the 1.3200 resistance might open the doors for more gains towards the 1.3240 and 1.3260 levels.

The next major resistance sits at 1.3300. Conversely, there is a risk of a downside correction below 1.3180. The first major support is near the 1.3100 zone (the recent breakout zone).

Any further losses may perhaps lead GBP/USD towards the 1.3020 support zone and the 100 simple moving average (red, 4-hours).

Looking at EUR/USD, there was a sharp bearish reaction from 1.1910 after the Pfizer Inc. statement. More importantly, gold price trimmed all its gains and declined over $1,000 in the past three sessions.

Upcoming Economic Releases

- UK Claimant Count Change Oct 2020 – Forecast 36K, versus 28K previous.

- UK ILO Unemployment Rate Sep 2020 (3M) – Forecast 4.8%, versus 4.5% previous.

- German ZEW Business Economic Sentiment Index Nov 2020 – Forecast 41.7, versus 56.1 previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals