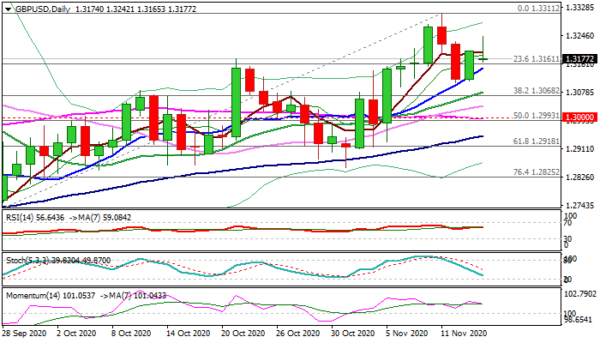

Attempts to extend last Friday’s 0.65 advance stalled on Monday, as jump to the session high (1.3241) was so far short-lived and the action returned below 1.3200 handle.

Larger uptrend from 1.2675 (23 Sep low) remains in play, with pullback after bull-trap above Fibo barrier at 1.3291), expected to offer better buying opportunities, while dips stay above daily cloud top / rising 20DMA (1.3078).

Bullish setup of daily techs continues to support recovery, but initial warning signals develop on weekly chart.

Long upper shadow of last week’s candle warns that demand is running out of steam, with fading bullish momentum and stochastic approaching overbought territory, add to negative signals.

Caution on break of Fri/Thu lows (1.3109/06) that would bring in focus pivots at 1.3078 and risk dip to next key supports at 1.3000 zone (psychological / 55DMA / Fibo 50% of 1.2675/1.3311) on break.

Res: 1.3200; 1.3242; 1.3278; 1.3311

Sup: 1.3131; 1.3149; 1.3106; 1.3078

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals