NZDUSD’s Bullish Bias Durable Despite Consolidation

NZDUSD is retreating from its freshly plotted 31½-month high of 0.7113 in the four-hour chart, as positive drive seems to have taken the back seat, something also reflected in the directionless Ichimoku lines. That said the solid bullish bearing of...

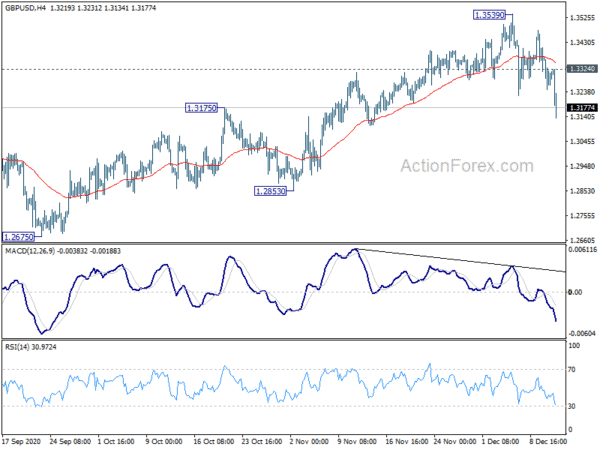

Sterling Accelerates Lower as No-Deal Brexit Looking Very, Very Likely

Sterling’s selloff accelerates further today after leaders from both EU and UK admitted that their negotiations positions are still part. No-deal Brexit is now seen as the most likely scenario, and we should know very soon by the end of...

GBPAUD Extends Downtrend to Fresh 2-Year Lows

GBPAUD is looking for a close near a fresh two-year low of 1.7424 and below the 1.7540 base, which triggered September’s upward correction and stretched July’s appreciation to a four-month high of 2.0845, after Thursday’s steep decline. The Stochastics and...

Stocks making the biggest moves in the premarket: Disney, Qualcomm, Nio, Lululemon & more

Take a look at some of the biggest movers in the premarket: Walt Disney (DIS) – Disney said its Disney+ streaming service now has 86.8 million subscribers, a number it says could grow to 260 million by 2024. The company...

XAU/USD Might Decline

Since Thursday, the XAU/USD exchange rate has been trading sideways in the 1,830/1,850.00 range. Given that yellow metal is pressured by the 55-, 100– and 200-hour SMAs in the 1,836.00/1,850.00 range, it is likely that some downside potential could prevail...

GBP/USD Trades Below 1.3250

During Friday morning hours, the GBP/USD exchange rate tumbled below 1.3250. It is likely that the currency pair could gain support from the weekly S2 at 1.3174 and reverse north in the nearest future. Note that the pair could face...

EUR/USD Remains Below 1.2160

Since Thursday, the EUR/USD currency pair has been testing the psychological level at 1.2160. It is likely that the exchange rate could gain support from the 55-, 100– and 200-hour SMAs in the 1.2110 area. Thus, some upside potential could...

US 30 Index Falls Slightly, Broader Outlook Is Positive

The US 30 stock index (Cash) is edging south from its freshly logged all-time-high of 30,313.56. Positive sentiment seems to be taking a breather as the momentum indicators are losing some momentum. The MACD, in the positive region, is holding...

EUR/USD Bulls Are Waiting For Retracement

The EUR/USD is bullish. The price is in retracement, so if the market drops to the POC zone we will possibly see a bounce. 1.2070-80 is the zone where bouce is expected. We can also see historical buyers at the...

Australian Dollar Accelerates Up with Iron Ore Prices, Euro Capped after Post ECB Rally

Accelerating rally in iron ore prices pushes Australian broadly higher today, on the back of steadily firm risk sentiment. The Aussie is currently the strongest one for the week, followed by New Zealand Dollar, while Canadian is not far away,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals