December’s employment report for Australia is likely to attract investors’ attention on Thursday at 00:30 GMT. Technically, the recession is over in the country as the economic indicators have turned positive, however, the recovery is not. Unemployment is expected to take two to three years to return to pre-pandemic levels and looking at the nation’s currency, it is holding near recent highs.

Unemployment rate predicted to drop to its lowest level since April

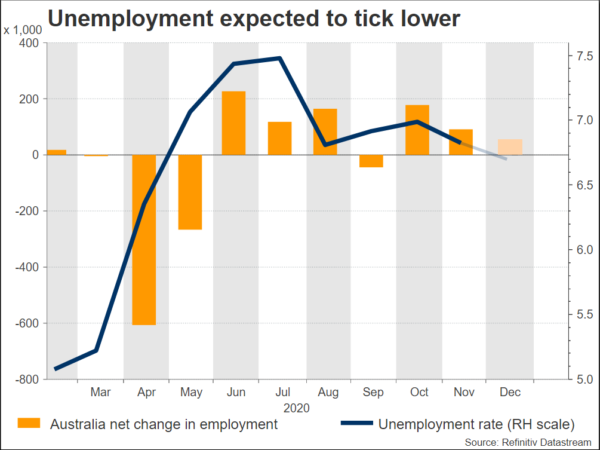

In the previous release, the unemployment rate unexpectedly fell to 6.8% in November versus October’s figure of 7%. This was the lowest jobless rate since August, as the economy gradually emerged from the pandemic hit. December’s prediction for the unemployment rate is to tick even lower to 6.7%, which would be the lowest since April.

Employment rose by 90k between the previous two months, well above market expectations of a 50k increase, reflecting an ongoing strengthening in Victoria’s labour market. For December, the economy is forecasted to have shed 50k jobs. Though, the participation rate is predicted to rise to 66.2%.

Retail sales show improvement

In the previous week, retail sales in Australia climbed by 7.1% m/m in November from 7.0% growth previously and after a 1.4% increase a month earlier. This rise was the fastest gain in retail sales since May after the reopening of non-essential stores in Victoria as the coronavirus restrictions were eased.

RBA cash rate holds at 0.1%

Moreover, during December’s meeting, the Reserve Bank of Australia kept its cash rate unchanged at a record low of 0.1% as expected after the decrease from 0.25% in October. Policymakers repeated their promise for doing more for jobs, incomes and businesses in the country and endorsed that there is no expectation for an increase of the cash rate for the next three years at least. Also, they mentioned it will not raise the cash rate until actual inflation is within the 2 to 3% target band.

Technical view: Aussie stands below 33-month high

Technically, aussie/dollar has moved slightly lower, dropping near the 20-day simple moving averages (SMA), showing a flattening mode. The price could be at risk of a bearish retracement if the employment report disappoints. Price action is likely to challenge again the 0.7640 support level, while even lower a test of the long-term ascending trend line could come around 0.7580. A step lower could open the way for a bearish retracement, flirting with the 0.7464 before moving sharply lower to the 200-day SMA at 0.7095.

If the unemployment rate falls further, the price may move higher towards the 33-month high of 0.7820 ahead of 0.7920, taken from the high of March 2018. Above that, the peak from January 2018 at 0.8130 could come into the spotlight.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals