U.S. Highlights

- Economic data released this week was balanced enough to re-ignite optimism in financial markets without calling into question the next fiscal support package.

- Job market data showed a third consecutive decline in the weekly jobless claims as well as moderate progress in payrolls and an unexpected drop in the unemployment rate.

- Assuming continued progress on the health front, another round of substantial fiscal supports could push the American economy from stall speed to an outright sprint in the second half of this year.

Canadian Highlights

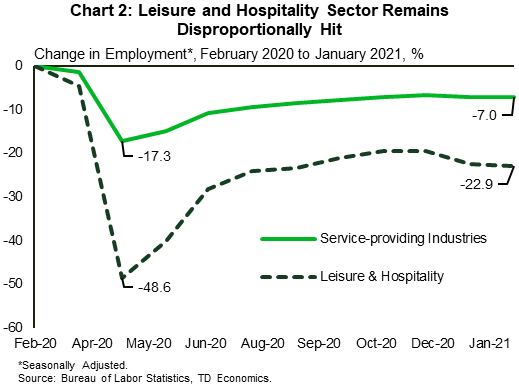

- Oil prices shot higher this week on significant OPEC+ compliance on production cuts.

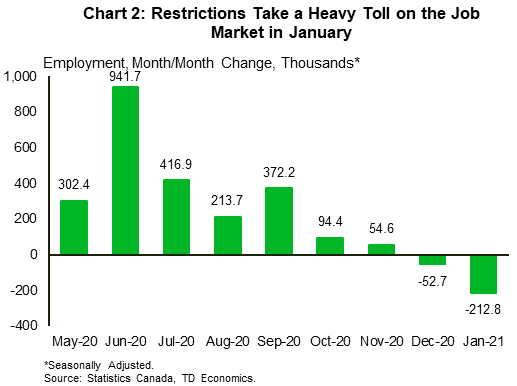

- Employment dropped by a worse-than-expected 213k positions in January, weighed down by renewed restrictions. Losses were concentrated in part-time jobs and total hours worked climbed a decent 0.9% on the month, blunting the headwind to GDP growth.

- Elsewhere, data on January manufacturing sentiment and home sales were better. With restrictions being eased in Quebec and Alberta (and perhaps Manitoba), a better growth performance could begin to take shape in February.

U.S. – A Cautiously Optimistic Week

This week, one of the world’s most famous prognosticators, Punxsutawney Phil, reportedly predicted another six weeks of winter followed by “one of the most beautiful and brightest springs you’ve ever seen.” Economists seem to agree, forecasting weak short-term growth followed by a strong rebound later in the year. The timing and extend of the latter depend on getting enough people vaccinated to return to normal activities and spending habits. As of this week, daily vaccinations held at roughly 1.3 million doses. They are targeted to expand to 1.5 million a day to reach the Biden administration’s goal of 150 million vaccines administered by the end of April.

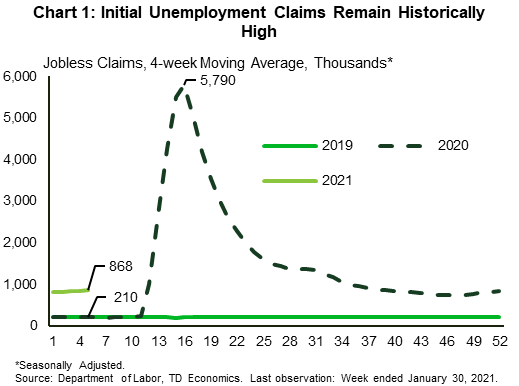

At present, the job market shows tepid signs of improvement. On Thursday, the Department of Labor reported a third consecutive decline in the weekly number of Americans seeking unemployment benefits. Recent reports come with the caveat of considerable revisions due to difficulties in adjusting the historically-high level for seasonal factors. Even when smoothed over four weeks, claims remain around 650 thousand higher than a year ago (Chart 1).

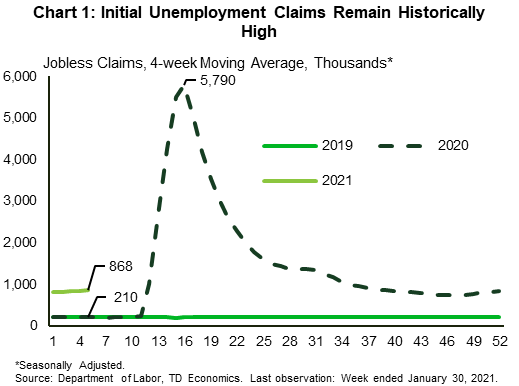

Likewise, today’s employment report for January showed moderate progress, with payrolls rising by 49 thousand, while the unemployment rate unexpectedly fell to 6.3% from 6.7% in December. Despite this progress, the economy has thus far recovered just over half of jobs lost during the initial lockdown period. The pandemic continues to inflict disproportional pain on the services sector, deepening inequalit. One particularly dire spot remains the leisure & hospitality sector, which reported another month of losses in January. With the setback, employment in the sector is now 22.9% below its pre-pandemic level (Chart 2).

In other data releases, ISM manufacturing and services sector indexes remained in expansionary territory. The manufacturing index dropped by two points (indicating a slowdown in growth), while the non-manufacturing index rose by one (indicating accelerating growth). While supply chain backlogs remain problematic, the increase in employment sub-components, especially in the services index, gives cause for optimism on the jobs recovery.

On the financial front, economic data was balanced enough to re-ignite optimism in financial markets without calling into question the next fiscal support package. The S&P 500 index ended the week 4.7% higher than the previous week and the 10-year U.S. Treasury rose to 1.15% from 1.08%.

This week, a report by the Congressional Budget Office estimated that the recently passed $900 billion stimulus package (signed into law at the end of December) would raise the level of GDP by 1.5% in 2021 and 2022, with most of that boost occurring this year. At $1.9 trillion, the next proposed round of fiscal support is even bigger. The income supports in the package will go a long way to bridging the gap to the other side of the health crisis and, with additional funding for vaccine distribution and testing, hopefully speed it along. Assuming continued progress on the health front, there is a good chance that the economy moves from stall speed to an outright sprint in the second half of this year.

Canada – The Peak Of The Trough

North American bourses enjoyed buoyant gains this week. For its part, the TSX increased through the week, even in the face of a soft jobs report. In terms of drivers, energy shares were boosted by oil’s rapid ascent. The WTI benchmark rose by about $5/barrel this week (Chart 1), trading in the mid/high $50’s range, as reports indicated near uniform compliance by OPEC+ in terms of production cuts last month. Other TSX sub-indices also climbed higher in the week.

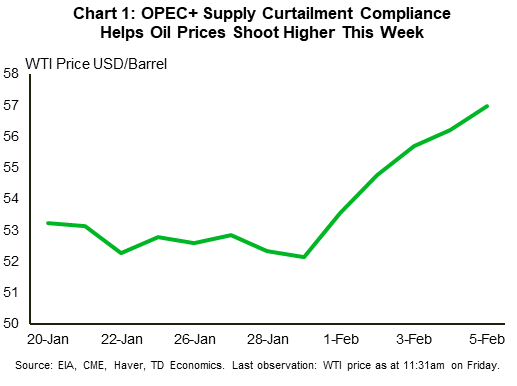

In terms of data releases, the marquee event was undoubtedly today’s Labour Force Survey. Employment tumbled by 213k positions last month (Chart 2), bringing it to its lowest level since August. Restrictions imposed to fight the spread of the virus left a major imprint on the report, with employment in accommodation and food services, information, culture and recreation and other services down by 100k positions. As has been made painfully clear during the pandemic, a large chunk of “high-touch” jobs are contained in these categories. However, the steepest decline belonged to the trade sector, which saw employment plunge by 168k amid retail industry closures imposed in Ontario and Quebec. Indeed, these two provinces accounted for most of the headline weakness. The dismal performance in retail hiring is consistent with mobility data, which last month posted one of the weakest showings since the pandemic began. Also on the soft side, the unemployment rate climbed 0.9% percentage points to 9.4%.

However, when you peel away the ugly headline, underlying details of the report were better. For one, losses were fully accounted for by part-time jobs, while full-time employment picked up slightly. In addition, net hiring increased in industries not directly affected by the pandemic. Finally, hours worked surprisingly climbed 0.9% on the month, which suggests economic activity may have held up despite the overall jobs decline.

Other data released this week for the month of January were more upbeat. The IHS Markit manufacturing index dropped, but remained above the 50 threshold, indicating expansion. Meanwhile, the housing market continued its strong run, as data from several real estate boards signaled yet another gain for home sales. Also positive for growth – albeit for this month – is Quebec’s announcement that restrictions on several industries will be eased starting Monday. Rounding out the releases, December’s international trade report was mixed, with export volumes rising and imports contracting – suggesting a positive contribution from net trade. However, the drop in imports of consumer goods points to softer household spending to end the year.

Reviewing the events of the week, one comes away with the impression that it could have been worse. Looking past the terrible headline jobs print (which admittedly is a tough thing to do), oil prices rose, equities bounced, hours worked increased in January, and other data releases skewed positive. With new cases on a downtrend and provinces like Alberta and Quebec easing restrictions instead of tightening them, the growth picture looks poised to improve as early as this month. And, while the path ahead is uncertain and fraught with challenges, we can draw comfort from this.

U.S: Upcoming Key Economic Releases

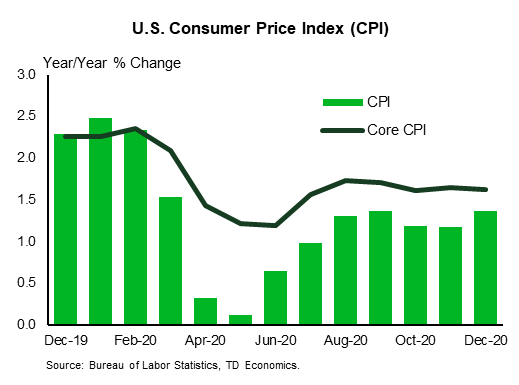

U.S. CPI – January

Release Date: Feb 10

Previous: 0.4% m/m, 1.4% y/y; core 0.1% m/m, 1.6% y/y

TD Forecast: 0.3% m/m, 1.4% y/y; core 0.1% m/m, 1.5% y/y

Consensus: 0.4% m/m, 1.5% y/y; core 0.2% m/m, 1.5% y/y

Oil prices have bounced, and the gasoline component of the CPI likely rose sharply again in January, but we expect another tame reading for the trend-setting core series, even with some tendency for above-trend gains in January in recent years. The rise in the core index was probably held down by a fourth consecutive decline in used vehicle prices (after sharp increases) and minimal gains once again in the rental components. We continue to view COVID as disinflationary, on balance. Our forecast implies 1.4%/1.5% y/y for total/core prices in January, little changed from 1.4%/1.6% y/y in December and down from 2.3%/2.4% y/y in February 2020 (pre-COVID).

Note also that the BLS will be releasing its annual revision to the seasonal adjustment factors for the CPI on Monday, February 8. Revisions are typically small and offsetting; the not seasonally adjusted data are not revised.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals