U.S. Highlights

- One year after the start of global lockdowns, it is starting to feel like the end is finally approaching. The new fiscal package signed into the law will continue to support a stronger economic recovery and the financial resilience of American households.

- The Consumer Price Index (CPI) came in on market expectations, while core CPI edged lower in February, giving inflation anxiety a short break.

- The 10-year U.S. Treasury yield is on the upward trend again, but the Fed’s primary concern remains a sustained labor recovery. With the virus still spreading, the recovery remains fragile and unequal, requiring policy to remain accommodative.

Canadian Highlights

- The Canadian economy continues to show its resiliency in the face of the pandemic. In February, the economy added 259 thousand jobs, nearly replacing all the jobs lost to lockdowns in December and January.

- The robust pace of job growth pushed the unemployment rate down 1.2 percentage points to 8.2%, the lowest since March of last year.

- The Bank of Canada left policy unchanged this week. Deputy Governor Schembri explained the decision, noting solid economic data and upside risks to the Bank’s outlook, but also uncertainties around the course of the virus and labor market scarring.

U.S. – A Year of COVID

This week marks one year since the start of global lockdowns and economic disruptions due to the coronavirus pandemic. And while no one can say that the crisis is over, it is starting to feel like the end is finally approaching. Thanks to unprecedented policy support, the economic slump has been short-lived, and prospects for recovery look much brighter than initially predicted. We expect that the American Rescue Plan, signed into effect on Thursday, will lift economic growth to roughly 6% this year, the highest rate since 1984.

The new fiscal package is huge. It provides a fresh round of $1,400 checks starting as early as this weekend, extends unemployment benefits of $300 per week until September, increases the child tax credit (and makes it fully refundable), provides aid to states and local governments, supports schools and expands vaccination efforts.

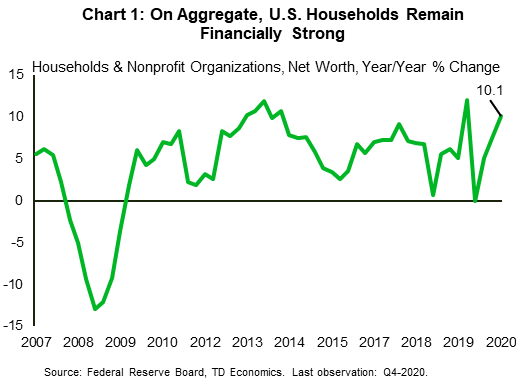

Substantial income supports have enabled Americans to maintain strong balance sheets through this crisis. According to the Fed’s data released yesterday, U.S. households’ and non -profit organizations’ net worth reached a record high of $130 trillion, growing 10% in the last quarter of 2020. (Chart 1). Nevertheless, income and wealth disparities, exacerbated by the crisis, continue to pose risks to the recovery.

On the economic front, data was scarce this week. A highly anticipated Consumer Price Index (CPI) report came in on market expectations. Gasoline and food prices continued to rise, driving the headline index 1.7% higher over the past year. Still, core inflation (excluding these volatile categories) remained soft, rising by 0.1% on the month and edging lower on the year-on-year basis to 1.3% from 1.4% in January.

Still, a closer look at the core prices reveals a shift in recent trends. Supported by the housing component of the index, the decline in core services prices was halted at 1.3% year-on-year (Chart 2) in February. Indeed, strong demand for housing has lifted home prices by at least 10% since 2019, even as rents in major urban centers have gone in the opposite direction. Goods’ price growth, on the other hand, softened in February reflecting a pull-back in used car prices, one of the biggest price outperformers of the pandemic.

The news of muted price growth gave the market’s inflation anxiety a short break. The 10-year U.S. Treasury yield subsided from its last week’s peak of 1.60% to just under 1.50%, before bouncing back to almost 1.62% at the time of writing. Despite solid demand in this weeks’ three U.S. Treasury auctions, investors are increasingly betting on higher inflation. As we wrote recently, the Fed will be mindful of mounting price pressures, but its new framework gives it more wiggle room for letting inflation move above 2%.

The Fed’s primary concern remains a sustained labor recovery. With the strongest economic growth in recent history, this should be achieved over the next two years. In the meantime, with the virus still spreading, the recovery remains fragile and unequal, requiring policy to remain accommodative.

Canada – Economic Resiliency On Display Again

The pandemic economy has presented new challenges for forecasters. Updating the economic outlook has required following the course of the pandemic and adjusting to public health announcements. But, the economic impact of lockdowns has not been constant over time. The first round of lockdowns was extremely severe, but later rounds have had smaller negative impacts as businesses and households better adapted to the pandemic and associated restrictions.

At the same time, the usual volatility in economic data has been supercharged. Nowhere is this more apparent than in the labour market. Canada’s monthly Labour Force Survey (LFS) is already notoriously volatile, but the last few months have been off the charts. After shedding 265 thousand jobs in December and January (1.4% of the total) as lockdowns tightened in Ontario and Quebec, nearly all of these (259k) were added back in February (Chart 1). As a result, the unemployment rate has seesawed, rising to 9.4% in January before falling back to 8.2% in February (Chart 2) – the lowest level since March of last year.

Volatility notwithstanding, economic forecasts are once again on the upswing. This is partially due to continued progress on producing and distributing vaccines – though Canada has lagged on this front – but even more, it is due to evidence that the economy has proved much more resilient to the continuation of the health crisis. Instead of pulling back, economic growth has remained positive. At the same time, while job losses were felt in industries directly impacted by lockdowns, other sectors added jobs and hours, and recovery has been swift as restrictions were lifted.

This is a challenge not only for humble bank economists like us, but also for the Bank of Canada, who sets its forward policy guidance based on its economic outlook. For the Bank, forecast upgrades represent an additional challenge, suggesting a need to change course on monetary stimulus in response. Deputy Governor Lawrence Schembri had to walk this fine line as he explained the recent Bank of Canada decision to leave rates, asset purchases and forward guidance unchanged.

Schembri noted the challenge in economic forecasting and the likely upgrades to the economic outlook from better-than-expected data, but he also noted the long-road ahead for the labor market. Notably, his speech took place before Friday’s LFS release, but the general theme of his remarks – the disproportionate impact of job losses on lower-wage, younger workers, and women and uncertainty on how quickly these jobs will return given economic restructuring – remain relevant.

Still, there is no doubt that with a stronger-than-anticipated recovery, monetary policy may no longer have to be maintained at emergency levels. As Schembri also noted, the large increase in personal savings – another unanticipated consequence of the pandemic economy – presents yet another source of upside risk to the economic outlook. Should this savings turn into spending to a greater degree than anticipated over the next year, the economy will surpass even upgraded expectations and monetary policy will have to respond in kind.

U.S: Upcoming Key Economic Releases

U.S Retail Sales – February

Release Date Mar 16

Previous: 5.3% total, 5.9% ex-autos, 6.0% control group

TD Forecast: -2.0% total, -2.0% ex-autos, -3.5% control group

Consensus: -0.3% total, 0.2% ex-autos, -1.0% control group

Retail sales appear to have plunged in February, but the estimated 2.0% drop follows a larger 5.3% surge in January. Spending was likely depressed by harsher-than-usual winter weather, most notably in Texas, as well as a fading of the boost from the stimulus payments disbursed in early January (from the $0.9tn stimulus package enacted in December). Spending will likely be boosted in coming months by another round of stimulus payments (from the just-enacted $1.9tn package) and ongoing easing of COVID restrictions.

U.S. FOMC Meeting – March

Release Date: March 17

Previous: 0.25%

TD Forecast: 0.25%

Consensus: 0.25%

Fed officials are likely to raise their 2021 growth projections sharply for the FOMC meeting. We expect changes to inflation and funds rate projections to be much more modest, however; the median “dot” will probably still show no tightening through end-23, and the tone will likely remain dovish. That said, the mean dot will probably move up slightly, and we don’t expect officials to signal any major problem with the recent backup in bond yields.

Canada: Upcoming Key Economic Releases

Canadian Manufacturing Sales – January

Release Date: March 15

Previous: 0.9%

TD Forecast: 3.5%

Consensus: NA

Manufacturing sales are forecast to rise by 3.5% in January, above flash estimates from Statistics Canada, on the heels of broad-based strength in exports. Nominal exports rose by 5.5% m/m even without the outsized contribution from the aerospace sector, which benefitted from a surge in used aircraft exports that will not be reflected in the manufacturing report. Forestry products and petroleum shipments will provide a source of strength, while motor vehicles should weigh on the headline print due to lower auto production, caused by factory shutdowns. With industrial prices 1.9% higher in January, real manufacturing sales should print well below the nominal increase, although we still anticipate a healthy contribution to industry-level GDP.

Canadian Consumer Price Index – February

Release Date: March 17

Previous: 0.6% m/m, 1.0% y/y, Index: 138.2

TD Forecast: 0.6% m/m, 1.2% y/y, Index: 139.1

Consensus: NA

We look for headline CPI to edge higher to 1.2% y/y in February, pushing through the bottom of the Bank of Canada’s target range for the first time since February 2020. Higher energy prices will provide the driving force behind an anticipated 0.6% m/m increase, with gasoline singlehandedly contributing 0.2pp to the month-over-month print and helping to lift the energy component into positive territory on a year-ago basis. Seasonal tailwinds will provide another source of strength, with apparel and travel services among the components that usually see a stronger performance in February. New quarantine measures for international travel introduce some added upside risk to travel services/accommodation, but since the policy was introduced on February 21st this could be a story for March. Core inflation measures should hold between 1.7-1.8% on average, with some downside risk to the trimmed mean and weighed median measures.

Canadian Retail Sales – January

Release Date: March 19

Previous: -3.4%, ex-auto: -4.1%

TD Forecast: -2.0%, ex-auto: -2.5%

Consensus: NA

We look for retail sales to push lower with another 2.0% m/m decline in January, leaving them 5.3% below November levels as COVID lockdowns continue to take their toll. While lockdown measures also weighed on the December report, the StatCan release notes that impacted businesses were only closed for two days on average, and mobility data shows a material decline in foot traffic across all regions. While some of this may be explained by seasonality/holiday shopping, we anticipate the net result will be another significant decline in the ex-autos measure (-2.5%). Motor vehicles should see a more modest decline, while gasoline stations will add a source of strength on higher prices at the pump.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals