U.S. Highlights

- Markets see-sawed on the week as investors were pulled between positive economic news and concerns about rising bond yields and rising Covid-19 cases in Europe.

- Soft U.S. economic data for February, which was hit by severe winter weather, is likely to be a pothole on the road to much stronger growth in the spring.

- With vaccinations gathering speed, the day is fast approaching when consumers will feel safe returning to close-contact activities. This boost to the services sector will help drive an acceleration in the job market in the spring.

Canadian Highlights

- Budget season is in full bloom. This week saw Ontario, Quebec, and Nova Scotia release their 2021 plans. Meanwhile, the federal government announced the national budget will be tabled on April 19th.

- Provincial spending will remain elevated in the years to come with both Ontario and Quebec outlining new support measures in their respective budgets. Stronger economic growth is expected to gradually ease the debt burden.

- The federal government appears poised to place emphasis on its objective to “build back better.” Proactive fiscal policy is likely to have some staying power.

U.S. – Bad February Data a Temporary Setback

Equity markets see-sawed this week as investors were pulled between positive economic news and concerns about rising bond yields and rising Covid-19 cases in Europe. After several weeks of increases, there was some give back in the 10-year Treasury yield, even as Fed speakers seemed relatively unconcerned about the move up in yields.

One positive economic headline came from the weekly jobless claims, which were at the lowest level since the pandemic began. Claims are moving in the right direction, but the headline lacks context. 684 thousand claimants in the week of March 20th is still higher than any of the worst weeks in 2009 during the Great Recession. Also, that figure only accounts for regular state benefits, which many workers have exhausted a year into the pandemic.

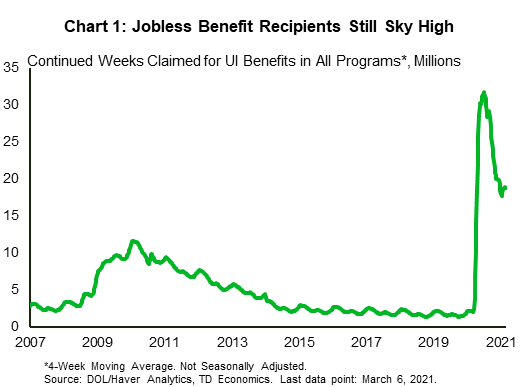

Looking at continuing claims in all programs – including the emergency federal pandemic programs – 7.2% of the 16+ population (or nearly 19 million people) were collecting benefits of some kind in early March (Chart 1). That is a staggering number, which in part reflects the expansion of benefits under last year’s CARES Act, but also the steep hill left to climb when it comes to the job market.

This was the message echoed by many Fed speakers this week. Namely, that the Fed will continue to provide support to the economy until the job market recovery is “well and truly done” and that the recovery is “far from complete.” The ramp-up in vaccinations we are seeing is critical to accelerating the employment recovery, which lost momentum in the winter as lockdowns were tightened.

The job market recovery will accelerate once spending on services does. Services industries are far more employment-intensive than goods ones, and much of the goods consumption in the U.S. is imported, and does not generate as many jobs domestically (Chart 2). For services spending to normalize further, people need to feel safe returning to close-contact and group activities like movie theaters and travel. This is likely to take place once people, particularly those who are more vulnerable, are vaccinated.

Next week we will get the March jobs numbers, which we expect will show continued improvement, but our forecast calls for employment growth to really pick up the pace in the second quarter, as vulnerable populations as well as a significant swath of the adult population are vaccinated.

In that context, the weak February data released this week is likely to prove a pothole on the road to a much stronger recovery in the spring. The severe winter storms that caused blackouts and disruptions in large parts of the southern U.S. were partly to blame for the drop off in spending and home sales in February. However, with the very low inventory level of homes on the market – down almost 30% relative to a year ago – prices remain lofty. The median single-family home price is up over 16% versus a year ago – the fastest pace since 2006. That may seem an ominous comparison, but the dynamics are very different. Activity in the resale market on a trend basis is nowhere near the heady days of 2005-06, and we expect as the risks from the pandemic ebbs, more people will be enticed to list their homes, taking some pressure off prices.

Canada – Budget Season in Full Bloom

The first day of spring brought sunshine, warmer weather, and a very exciting budget season. This week saw Ontario, Quebec, and Nova Scotia release their 2021 plans. And finally, after two years in the making, the federal government announced that the national budget will be tabled on April 19th. There is much curiosity on what the federal government will prioritize as the economy emerges from the pandemic, but one thing is certain, fiscal spending will be elevated for some time to come.

Provinces are already signaling this in their budgets. Recognizing the continued challenges to the economy and to address the vulnerabilities exposed by the pandemic, both Ontario and Quebec announced several new spending initiatives. Ontario introduced a third round of payments to parents through the Ontario COVID-19 Child Benefit, made $1.7 billion available to small businesses and is investing $400 million over the next three years to support the tourism, hospitality and culture industries. Quebec is investing $2.9 billion in health care and allocating $300 million to improving living conditions for the elderly.

Notably, both provinces did not include any new tax measures in their respective budgets. The debt burden, as measured by the debt to GDP ratio, is brought lower over the next several years through stronger economic growth that outpaces annual deficits (Chart 1). In terms of balancing the books, the provinces do not expect to see that happening until fiscal year 2027-2028.

The combination of sustained support from provinces and a stronger-than-expected economic recovery so far, has raised questions on whether federal stimulus needs to be as extensive as what’s been indicated by the government. In particular, some have suggested that the $70 to $100 billion left unallocated in last year’s Fall Economic Statement, may not be required, as it would further lift the federal debt to GDP ratio (Chart 2), while potentially overheating the economy. While this could be an issue, some industries are likely to continue to struggle for an extended period and targeted fiscal support may still be necessary.

At the same time, given the resiliency of Canada’s economy to the second wave of the pandemic, more emphasis may be placed on the government’s objective of “building back better.” That is, investing in projects that will increase Canada’s economic capacity once the health crisis is firmly in the rear-view mirror. Areas such as national daycare and pharmacare appear to be leading contenders in this regard. These initiatives, however, will not come cheap and will be challenging to implement, requiring coordination (and buy in) from other levels of government, especially provinces. The payoffs, however, could be significant. For example, if the rest of Canada could match Quebec’s success in providing affordable childcare, it could see a similar-sized lift in core-age female labour participation, boosting Canada’s labour force (and therefore economic potential) by as much as 1%.

We won’t have to wait much longer to see exactly which direction federal fiscal policy is heading, but proactive fiscal policy is likely to be front and center.

U.S: Upcoming Key Economic Releases

U.S. ISM Manufacturing Index – March

Release Date: April 1

Previous: 60.8

TD Forecast: 63.0

Consensus: 61.0

The already high manufacturing ISM index probably rose again in March, helped by COVID- and fiscal-stimulus-related optimism. A rise has been suggested by the regional surveys already released for the month.

U.S. Employment – March

Release Date: April 2

Previous: NFP 379k; UE rate 6.2%; AHE 0.2% m/m, 5.3% y/y

TD Forecast: NFP 1000k; UE rate 5.9%; AHE -0.1% m/m, 4.3% y/y

Consensus: NFP 628k, UE rate 6.0%; AHE 0.2% m/m, 4.5% y/y

Payrolls probably surged in March (forecast: up 1.0 million), helped by an easing of COVID restrictions. Gains are likely to remain historically large in the months ahead, helped by fiscal stimulus, although the net result at year-end will probably still be a pandemic-related decline. As of February 2021, payrolls were down 9.5 million from the level in February 2020. Surging employment is likely to be coupled with a recovery in the participation rate, but the net result should be lower unemployment. Average hourly earnings are likely to slow significantly in the months ahead due to more strength in low-wage than high-wage jobs. Such mix shifts led to the opposite pattern in the past year, with the 5.3% y/y pace in February 2021 up sharply from 3.0% y/y in February 2020. We expect the y/y pace to fall to 4.3% in the upcoming March report and to plunge to below zero in the April data.

Canada: Upcoming Key Economic Releases

Canadian Industry-level GDP – January*

Release Date: March 31

Previous: 0.1%

TD Forecast: 0.6%

Consensus: NA

We look for industry-level GDP to rise by 0.6% in January, exceeding flash estimates for 0.5% m/m, on a solid performance across goods and services. The performance is even more notable on account of harsh lockdowns across Eastern Canada and headwinds to auto production. Even with some drag on manufacturing, we look for more substantial gains across the goods-producing sector with a significant contribution coming from residential development/construction. In services, an outsized increase in wholesale trade should contribute roughly 0.2pp to the headline print, while real estate provides another source of strength. Further contraction in retail trade and accommodation/food services will weigh on activity, but we anticipate a smaller decline than last month with most of the impact already felt. New flash estimates will also receive attention for insight into growth conditions for February as lockdown measures are lifted across Eastern Canada.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals