Key Highlights

- GBP/JPY failed to surpass 152.00 and declined towards 150.00.

- Many hurdles are forming near 151.00 and 151.30 on the 4-hours chart.

- GBP/USD corrected gains after testing the 1.4000 resistance zone.

- The UK CPI increased 0.7% in March 2021 (YoY), up from 0.4%.

GBP/JPY Technical Analysis

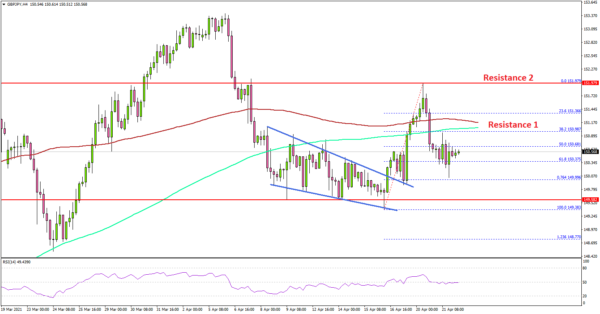

The British Pound started a fresh increase from 149.40 zone against the Japanese Yen. The GBP/JPY pair topped near 152.00 and it recently corrected lower.

Looking at the 4-hours chart, the pair traded as high as 151.97. It seems like there was a rejection near the 61.8% Fib retracement level of the key decline from the 153.41 high to 149.38 low.

There was a bearish reaction below the 151.00 support zone, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). However, the pair is still holding the 150.00 support zone.

Any more losses may possibly lead the pair towards the 149.40 support zone. On the upside, the pair is facing a lot of hurdles, starting with 151.00.

The first major resistance is near the 151.30 level and the 100 simple moving average (red, 4-hours). The next major resistance is near the 152.00 level, above which the pair is likely to accelerate higher towards the 153.50 level.

Fundamentally, the UK Consumer Price Index for March 2021 was released yesterday by the National Statistics. The market was looking for a rise of 0.8% compared with the same month a year ago.

The actual result was lower than the forecast, as the UK CPI increased 0.7%. However, it improved from the last reading of 0.4%. Looking at the monthly change, there was a 0.3% increase, up from 0.1%.

Overall, GBP/JPY could gain pace if it clears 151.00 and 151.30. Looking at GBP/USD, the pair struggled to clear 1.4000 and corrected lower.

Economic Releases

- US Initial Jobless Claims – Forecast 617K, versus 576K previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals