Turkish lira rebounded from new one-month (8.4340) posted on Monday, as traders collected profits after the last week’s advance showed signs of stall on approach to Mar 30 /22 lower tops (8.4443 / 8.5015).

Despite fresh strength, overall lira’s picture remains negative due to latest political tensions with the USA and pending interest rate cuts after new CBRT Governor Kavcioglu said that the central bank would keep monetary policy tight for now, but any rate hike would send a bad message for the real economy.

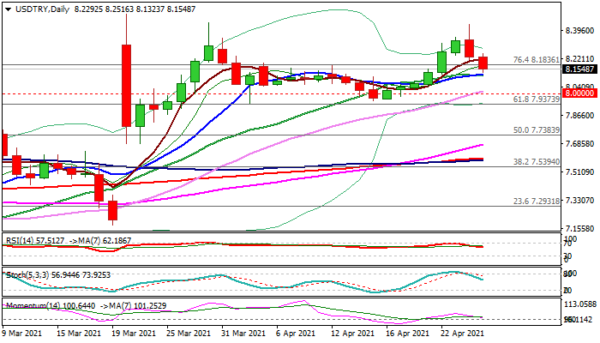

The pair moves within 7.95 and 8.44 range during the past month but remains biased higher while the price action stays above significant 8.00 support which contained two attempts during April.

Technical studies on larger timeframes are bullish, with retreating weekly indicators suggesting prolonged range-trade, but thick weekly Ichimoku cloud continues to support, while momentum on monthly chart remains in the positive territory since Dec 2019 and strongly underpins the action for renewed attack at all-time high (8.5819, posted on November 2020).

Firm break higher would signal continuation of larger uptrend and expose targets at 9.0000/9.2259 (psychological / Fibo 138.2% projection from 6.8951 (2021 low, posted on Feb 16).

Res: 8.1964; 8.2516; 8.3092; 8.3510

Sup: 8.1241; 8.1116; 8.0138; 8.0000

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals