The dollar made a soft start of the week and puled back from one-week high, posted after last Friday’s 0.76% advance.

Profit-taking and lowered volumes due to holidays in China, Japan and Britain, pushed the greenback lower on Monday.

Traders are more cautious ahead of key events this week (RBA, BoE rate decisions, US Apr NFP) which could provide clearer direction signals.

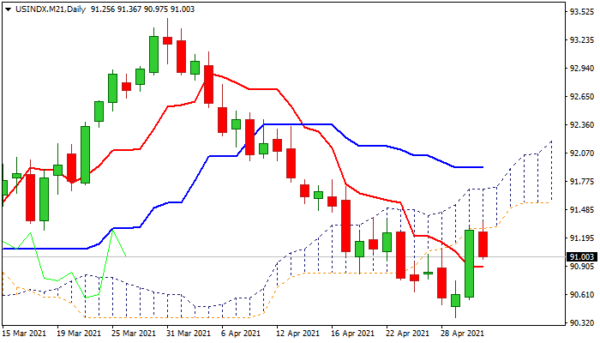

Daily studies weakened after the action was repeatedly capped by the base of rising daily cloud, as moving averages turned to full bearish setup and momentum remains deeply in the negative territory, warning that larger downtrend may resume after a mild correction.

Fresh bears cracked pivotal 91.01 support (100DMA/Fibo 38.2% of 90.37/91.36 recovery leg) with daily close below the support to further weaken near-term structure.

Res: 91.30; 91.56; 91.69; 91.98

Sup: 90.93; 90.79; 90.55; 90.37

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals