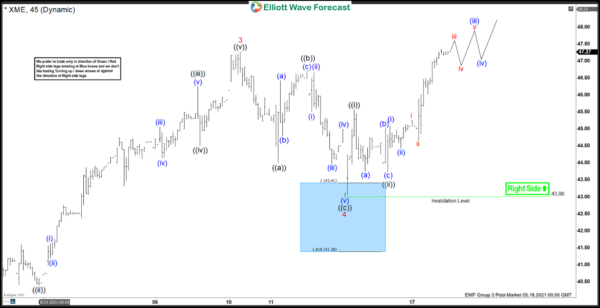

Short Term Elliott Wave structure for XME (S&P Metals & Mining ETF) suggests the rally from March 25, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Wave 3 of this impulse ended at 47.27 and pullback in wave 4 ended at 43. Internal subdivision of wave 4 unfolded as a zigzag. Down from wave 3, wave ((a)) ended at 44, and bounce in wave ((b)) ended at 46.70. The ETF then extended lower in wave ((c)) towards 43.

Wave 4 ended at the 100% – 161.8% Fibonacci extension from wave 3 at 41.38 – 43.41 and the ETF rallied nicely from there. It has broken above wave 3 high suggesting the next leg higher in wave 5 has started. Up from wave 4, wave ((i)) ended at 45.56, and pullback in wave ((ii)) ended at 43.74. Wave ((iii)) remains in progress and can see 3 more highs before ending. Afterwards, a pullback in wave ((iv)) is expected to correct cycle from wave ((ii)) low on May 14 before the rally resumes. Near term, as far as pivot at 43 low on May 13 stays intact, expect the ETF to extend higher.

XME 45 Minutes Elliott Wave Chart

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals