The Australian dollar rose to one-week high (0.7602) on Friday, lifted by fresh risk appetite as initial enthusiasm on hawkish Fed started o fade, as US policymakers remain split on risk view over surging inflation and large jobs deficit.

Traders focus today’s US core PCE data, as economists expect inflation to remain elevated in next few years.

The pair holds in green for the whole week and on track for nearly 1.5% weekly advance.

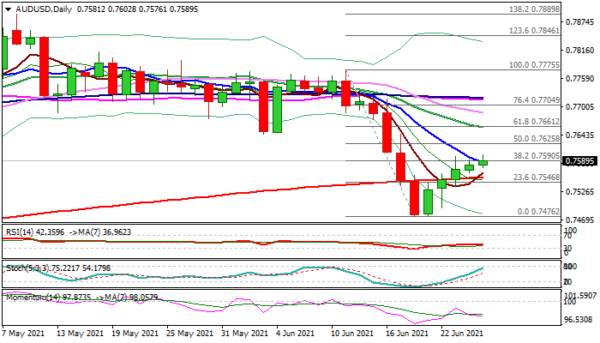

Upticks cracked pivotal barriers at 0.7586/90 (falling 10DMA / Fibo 38.2% of 0.7775/0.7476 bear-leg) but need weekly close above these levels to generate initial reversal signal and open way for further recovery of last week’s 3% drop (the biggest weekly fall since the third week of September 2020).

Daily techs remain negative and point to risk of limited correction before larger bears regain control, with focus on key 0.7590 zone.

Res: 0.7602, 0.7625, 0.7660, 0.7688.

Sup: 0.7576, 0.7556, 0.7494, 0.7476.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals