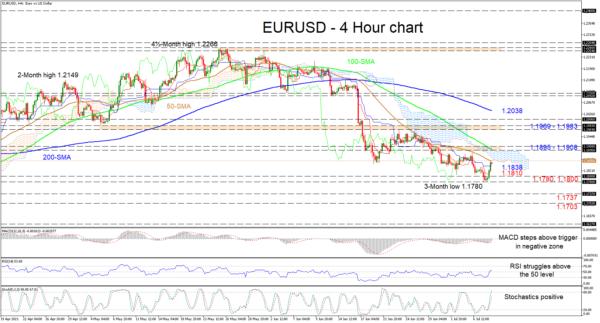

EURUSD has been logging green candles after finding its footing around a three-month low of 1.1780 and is pushing up against the 50-period simple moving average (SMA) at 1.1856, which has dismissed previous bounces ever since it adopted a downwards trajectory around June 11. Currently, the bearish SMAs are attempting to subdue growing buying interest.

The short-term oscillators are signalling growing positive momentum, while the Ichimoku lines are not indicating a convincing pickup in bullish impetus. The MACD has improved above its red trigger line and towards the zero mark, while the RSI is labouring to maintain a positive bearing. Moreover, the stochastic oscillator is promoting a strong bullish tone.

If the 50-period SMA at 1.1856 and the adjoining Ichimoku cloud manage to keep buyers at bay, early downside deterrence could occur from the Ichimoku lines at 1.1838 and 1.1810 respectively. If sellers start to dictate the price, next in line is the 1.1800 handle and the 3-month low of 1.1780. If the 1.1780 obstacle breaks down, the bearish outlook may power on, aligning its course with the 1.1737 barrier and the March 31 trough of 1.1703.

If together the 50-period SMA and the cloud fail to silence additional gains, buyers could quickly encounter another resistance belt of 1.1895-1.1908, which is fortified by the 100-period SMA. Should upside momentum accelerate, the 1.1969-1.1983 resistance border could be the catalyst to significantly bolster buyers confidence.

Summarizing, EURUSD is flashing green beneath the capping 50-period SMA and for its bullish labours to evolve the price would need to steer above the cloud around 1.1900.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals