EUR/USD Outlook: Bulls Lose Traction but Still on Course for Nearly 1% Weekly Advance

The Euro eases from one-month high on Friday, as bulls run out of steam following nearly 1% advance this week. US consumer spending rose above expectations in June and inflation accelerated further above Fed’s 2% target that boosted the dollar...

Key inflation indicator up 3.5% year over year in June for fastest gain since 1991

An inflation indicator that the Federal Reserve uses as its key guide rose 3.5% in June, a sharp acceleration that was nonetheless right around Wall Street expectations, the Commerce Department reported Friday. The personal consumption expenditures price index, which excludes...

Dollar Recovers after Personal Income and Spending, But Still the Worst Performer

Dollar recovers mildly in early US session, following slight weakness in risk sentiments. Additionally, stronger than expected personal income and spending are providing some support too. Still, the greenback remains the worst performing one for the week. There is prospect...

Euro Unchanged On Mixed GDP Data

The euro is in green territory for a fifth successive day as the dollar continues to show broad weakness. EUR/USD is up 1.1% this week and is poised to record its best week since May. German CPI outperforms target The...

EUR/CHF At The Strong Support

The EUR/CHF has had a big drop but its at an important support zone now. Buying the support might be a good option. We have two distinctive points for a velly for buyers. Historical and present support are close together....

EUR/USD Pair Is Now Consolidating Losses Near The 1.1880 Support

The Euro found support near the 1.1770 zone and formed a support base against the US Dollar. The EUR/USD pair started a decent upward move above the 1.1800 resistance. It surpassed the 1.1820 resistance level and settled above the 50...

USDCAD Looks For Buyers Near 1.2440, Bears Could Dominate

USDCAD retreated below the short-term supportive trendline and to a two-week low of 1.2431 on Thursday following the multiple rejections from the 200-day simple moving average (SMA). The current consolidation area around 1.2440 overlaps with July 9-13’s support region and...

GBP/USD Outlook: Cable Is On Track For Strong Weekly Gains, Bulls Pressure Key 1.40 Resistance Zone

Cable remains firm and holding near a five-week high on Friday, pressuring key barriers at 1.3990/1.4000 (Fibo 61.8% of 1.4249/1.3571/twisting daily cloud/psychological). The pair advanced strongly this week and is on track for the biggest weekly gains since the last...

GBPJPY Attempts To Overcome 40-Day SMA

GBPJPY is challenging the 40-day simple moving average (SMA) and the 153.40 resistance, following the bounce off the 148.45 support level. A successful jump above 153.40 could take the market towards the 40-month peak of 156.06 before meeting the 156.50...

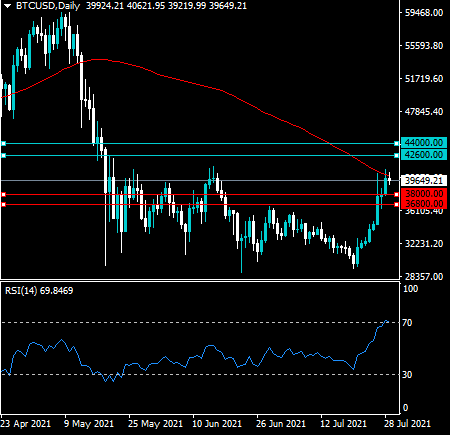

NEW! BTC/USD forecast. Bullish Hold

Technical analysis BTC The daily time frame shows that the BTC/USD pair is trading above its key 50-day moving average and attempting to break its 100-day moving average. The RSI indicator is approaching overbought territory across the daily time frame,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals