Dollar soared towards the end of the week as the stellar job report should give Fed much confidence to start tapering later in the year. Reactions from stock markets and yields were also positive, with DOW and S&P closing at new records while 10-year yield rebounded. Together with the steep fall in gold, overall development supports first rally in Dollar ahead, at least for the near term.

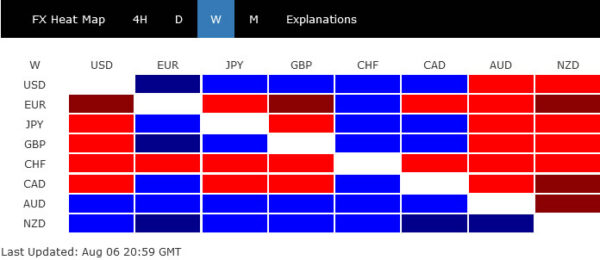

Nonetheless, Dollar’s strength was mainly seen against Euro, Swiss Franc and Yen. Aussie and Kiwi were in deed the strongest for the week while Euro and Swiss Franc were themselves the weakest. A key to watch now is whether comments from Fed officials could help push Dollar through recent resistance levels against Euro, as well as commodity currencies like Aussie, to solidify its momentum.

NFP a big step forward for Fed tapering

Fed moved a big step forward on tapering the asset purchase program with strong July non-farm payrolls job growth. Some officials like Governor Christopher Waller were clear that if job growth exceeds 800k in both July and August, then September is ready for a tapering announcement.

We’d expect more talks about the timing of tapering to come in the coming weeks, leading up to the Jackson Hole Symposium on August 26-28. Chair Jerome Powell might not be very clear on the tapering time by then, as August job numbers won’t be available yet. Also, there are still a lot of uncertainties over the spread of Delta variant and its impact on the economy. Nevertheless, more affirmative comments by him and other Fed officials could continue to give Dollar support.

Meanwhile, one more thing to be clear is that rate hike is a totally different topic to tapering. An early rate hike would really require inflation data proving itself rather non-transitory. For now, though, Fed funds futures are firmly pricing in nearly 60% chance of at least one hike by December 2022.

DOW hit new record, ready to extend up trend

The US stock markets have indeed responded rather well to the strong job numbers and expectations on Fed tapering. Both DOW and S&P 500 closed at new records highs. In particular, it now looks like DOW is ready to stand firm above 35k handle to resume the long term up trend.

Outlook will continue to stay bullish as long as 55 day EMA (now at 34517.38) holds. Next target is 38.2% projection of 26143.77 to 35901.56 from 33741.76 at 37159.81. That would be the key test to determine whether DOW could extend the up trend through to next year, as the economy would then hopefully be fully back to normal. If 37159.81 could be taken out decisively later in the year, 40k handle would be within reach next year.

10-year yield rebounded after drawing support again

10-year yield also rebounded strongly on Friday. 50% retracement of 0.504 to 1.765 at 1.134 provided strong support once again. It’s likely to see TNX breaking through 1.134 firmly if the economy continues to improve. Instead, break of 1.420 resistance will suggest that correction from 1.765 has completed at 1.128. Stronger rise would then be see back to 1.765 resistance. Such scenario could happen when Fed shows more confidence on tapering in Q4, and talk of a rate hike next year heat up.

DXY drew strong support from 55 day EMA

Dollar index also rebounded strongly to close the week at 92.80. The strong support from 55 day EMA is a bullish development. Rise from 89.53 looks set to resume for the near term, probably through 93.43 resistance. If that happens, DXY would also be taking out 55 week EMA rather firmly, which is a medium term bullish development.

The key focus would then be on 38.2% retracement of 102.99 to 89.20 at 94.46. As long as this fibonacci level holds, we’d continue to treat price actions from 89.20 as a corrective pattern only. However, strong break of 94.46 will argue that DXY is already in a medium term up trend, that would extend through 61.8% retracement at 97.72.

Gold to extend decline through 1750 to retest 1676 low

Gold also drops sharply along with the broad based rally in Dollar. The development suggests that recovery from 1750.49 has completed after failing to sustain above 55 day EMA. Fall from 1916.30 is ready to resume through 1750.49 to 1676.65 low.

We’d pay special attention to the reaction to 1676.65 support. Firm break there would bring some downside acceleration to extend whole down trend from 2074.84. Next medium term target would be 100% projection of 2074.84 to 1676.65 from 1916.30 at 1518.11. Such scenario, if happens, would be used to double-confirm DXY’s break of 94.46 fibonacci resistance, and probably TNX’s break of 1.765 high.

EUR/USD Weekly Outlook

EUR/USD dropped sharply last week and the development suggest rejection by 55 day EMA. Immediate focus is now on 1.1751 support. Break will resume fall from 1.2265 to 1.1602/1703 support zone. We’d look for strong support from there to bring rebound. But break of 1.1907 resistance is needed to confirm short term bottoming. Meanwhile, sustained break of 1.1602 will argue that it’s already reversing the trend from 1.1603, and target 61.8% retracement of 1.1603 to 1.2348 at 1.1888.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

In the long term picture, focus remains on 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516). Sustained break there should confirm long term bullish reversal and target 61.8% retracement at 1.3862 and above. However, rejection by 1.2555 will keep medium term outlook neutral first, and raise the prospect of down trend resumption at a later stage.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals