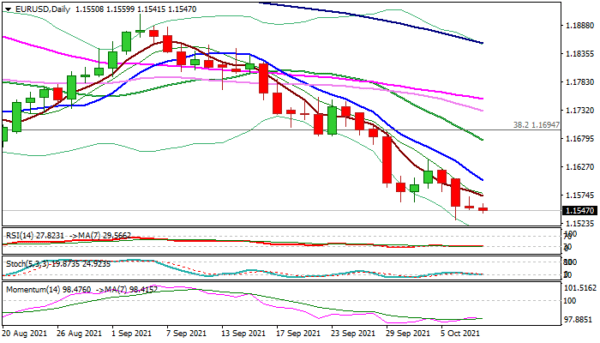

The Euro remains at the back foot but Thursday’s Doji and tight ranges in early Friday, signal hesitation, as bears face headwinds from cracked weekly cloud base (1.1538).

Traders await US jobs report for stronger signals with likely scenario of fresh dollar’s rally on expected solid NFP numbers, as well as lower unemployment in September.

Daily studies remain in full bearish setup and maintain downside pressure, with Friday’s close below weekly cloud to generate strong bearish signal, which would be boosted by break of next key support at 1.1492 (50% retracement of 1.0635/1.2349 ascend).

Falling 10DMA (1.1602) marks pivotal barrier, with sustained break here to sideline immediate bears, while lift and close above 1.1675 (falling 20DMA/Fibo 38.2% of 1.1909/1.1529) would signal reversal in the scenario which could be triggered by strong NFP miss.

Res: 1.1574, 1.1602, 1.1675, 1.1695.

Sup: 1.1538, 1.1492, 1.1402, 1.1290.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals