The WTI price probed through psychological $80 barrier for the first time since November 2014 on Friday and hit new 2021 high, on track for the fifth straight weekly gains and for over 5% advance this week.

Oil prices were boosted by global energy crunch that pushed natural gas prices to record high, on fears that a cold winter could add to obstacles in gas supplies, with many countries looking for alternative energies, such as coal. Rising natural gas and coal prices, as well as decision of the OPEC+ group to stick to gradual rather that strong increase in production, raised upside risks to the oil prices.

Many market observers expect the oil prices to continue rising and pointed to risk that oil could reach $100 per barrel within short period of time if the conditions in the energy sector do not improve.

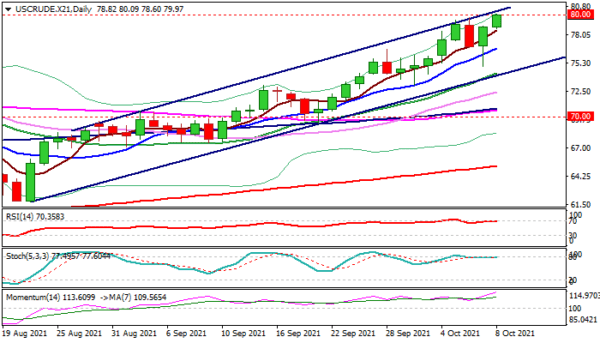

WTI contract price is currently riding on the fifth wave of five-wave cycle from $61.79 (Aug 23 trough) which broke above its Fibo 138.2% expansion and eyes $81.86 (FE 161.8%) and $85.24 (FE 200%).

Full bullish setup of daily/weekly studies supports the action, with weekly close above $80 level to add to strong bullish signals. Corrective dips, under current conditions, will be expected to offer better buying opportunities.

Res: 80.09; 81.86; 85.24; 89.25.

Sup: 79.60; 76.95; 75.49; 75.06.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals