Dollar Softer, Oil Rallies, Silver and Gold Sluggish

Dollar turn softer again in Asian session today and looks set to extend recent decline. But overall markets are quiet so far, with major pairs and crosses staying inside Friday’s range. Economic calendar is likely today and focuses will be...

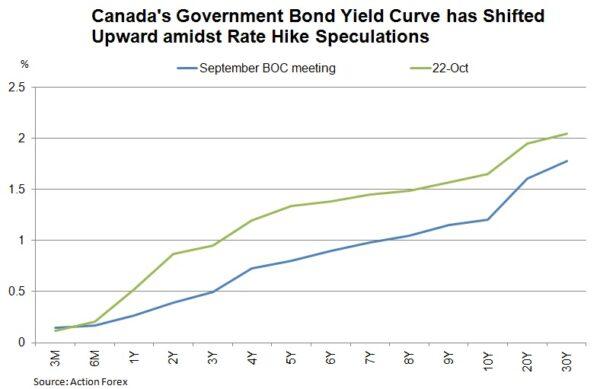

BOC Preview – Further QE Tapering

As further QE tapering to CAD 1B/week has been fully priced in, the focus of this week’s BOC meeting is the forward guidance on rate hike. The market has priced in 3 rate hikes in 2022. We expect the central...

Twitter and Square CEO Jack Dorsey says ‘hyperinflation’ will happen soon in the U.S. and the world

Jack Dorsey, CEO of Twitter and co-founder & CEO of Square, speaks during the crypto-currency conference Bitcoin 2021 Convention at the Mana Convention Center in Miami, Florida, on June 4, 2021. Marco Bello | AFP | Getty Images Twitter co-founder...

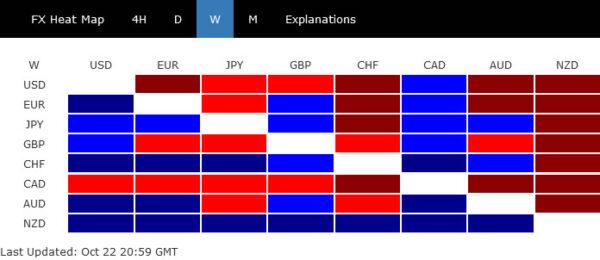

Dollar Ended Lower Despite Increasing Bets on Fed Hike, US Stocks Hit New Records

The markets have turned a bit mixed last week and have likely entered into a near term consolidative mode already. Dollar ended broadly lower even though traders continued to add their bet on a Fed rate hike next year. Indeed,...

Week Ahead: Central Banks Return, Political Drama and BIG Earnings

Without many catalysts for the markets over the last few weeks, potential market moving events will return in force this week! After a few weeks out of the limelight for major central banks, the BOC, BOJ, and ECB meet to...

Mexico’s Inflation Continues to Rise Despite Interest Rate Increases USD/MXN

At Mexico’s last central bank meeting on September 30th , Banxico hiked interest rates from 4.5% to 4.75% and said that the recent rise in inflation is transitory (like so many other central banks around the globe). They also stated...

The Weekly Bottom Line: Inflation Keeps on Persisting

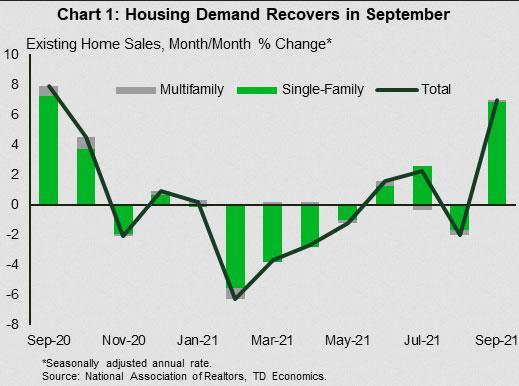

U.S. Highlights Inflation remained top of mind this week as economic indicators offered little evidence of moderation in supply-side disruptions. The bond market continued to reassess the path of monetary policy, pulling its expectations for the first rate hike forward...

Weekly Economic & Financial Commentary: Economic Disruption in China & U.K. CPI Fueling BoE Rate Hike Bets

Summary United States: Snarled Supply Chains Stymie Production Supply chain snags continue to bedevil the factory sector. Industrial production fell 1.3% in September. Tangled value chains are worsening building material shortages and hampering new home construction. During September, housing starts...

Week Ahead – Between a Rock and a Hard Place

Inflation is a growing concern For years central banks have been operating under the assumption that inflation will eventually return to target while having the flexibility to wait until the economy is fully ready for higher rates. That luxury is...

David Tepper doesn’t think stocks are a great investment here, but says it all depends on rates

Hedge fund manager David Tepper has turned somewhat bearish on the stock market, citing uncertainties around interest rates and inflation. “I don’t think it’s a great investment right here,” Tepper said Friday on CNBC’s “Halftime Report.” “I just don’t know...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals