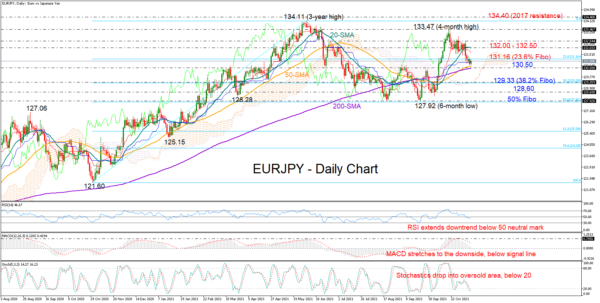

EURJPY has erased half of October’s rally, which peaked at a four-month high of 133.47, with the 50- and 200-day simple moving averages (SMAs) recently coming into the rescue to impede the sell-off around 130.50.

The technical status, however, is still bearish. The RSI has stretched its downtrend into bearish territory, while the MACD continues to lose ground below its red signal line as the Stochastics head back into the oversold zone.

Hence, unless the longer-term SMAs build a solid base, the price could tumble towards the 129.33 level, that being the 38.2% Fibonacci retracement of the 121.60 – 134.11 upleg. Falling lower, the price may attempt to pivot around 128.60 before the 6-month low of 127.92 comes on the radar.

On the upside, the 23.6% Fibonacci of 131.16 has been capping bullish actions the past two days. Therefore, a forceful move above that bar could be the key for a rally towards the 20-day SMA and the 132.00 barrier. Not far above, the 132.50 mark could delay any progress towards the 4-month high of 133.47.

Meanwhile in the medium-term picture, the pair is still in a trendless market, moving sideways between the 134.11 and 127.92 boundaries. Any violation at these limits would alter the neutral outlook accordingly.

In summary, despite the recent selloff, EURJPY bears seem to have more fuel in the tank. A break below 130.50 could confirm additional negative extensions, though in the medium-term picture a freefall below 127.92 would be needed to switch the neutral trajectory to bearish.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals