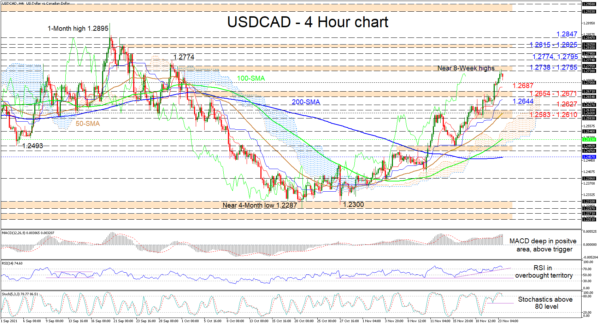

USDCAD advances have encountered some downside pressure from the 1.2738-1.2755 obstacle, formed by the October 1 and September 30 highs, hinting that bullish powers may be subsiding. However, the soaring 50- and 100-period simple moving averages (SMAs) are still backing the uptrend in the pair.

That said, the bullish Ichimoku lines are starting to signal minor waning in the upward drive as the red Tenkan-sen line’s incline falters, while the short-term oscillators are reflecting the increase in negative momentum. The MACD, far in the positive zone, is flattening above its red trigger line, while the RSI is falling in the overbought section and is looking to test the 70 level. The stochastic %K line has pierced beneath the 80 level and is promoting a bearish pullback in the pair.

If sellers manage to sustain their minor lead, initial downside friction could arise from the 1.2700 handle and the red Tenkan-sen line at 1.2687 ahead of the support border of 1.2654-1.2671. Breaching this, the blue Kijun-sen line at 1.2644 may delay the test of the 1.2627 low. In the event a deeper retracement evolves, the key 1.2583-1.2610 support boundary, which encapsulates the 50-period SMA, may attempt to halt additional declines from snowballing.

Alternatively, if buyers retake control, preliminary resistance could radiate from the 1.2738-1.2755 obstacle. If the bulls overcome the eight-week highs, they may then clash with the 1.2774 high from September 29 before confronting the 1.2795 barrier. If buying interest endures, the bulls could tackle the resistance band of 1.2815-1.2825 prior to aiming for the 1.2847 mark.

Summarizing, USDCAD is sustaining a bullish bearing above the 1.2654-1.2671 boundary and the SMAs, despite the fresh minor pullback. That said, for the bears to regain the upper hand, the price would need to drop below the 1.2492 trough.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals