While Dollar is so far the strongest one for the week, there is clearly no follow through buying. The greenback is stuck in range against most others with traders on the sideline ahead of FOMC. Canadian and New Zealand Dollars are the two exceptions, which are already breaking through near term support against Dollar. We’ll see if other pairs would finally follow with breakouts.

Technically, as with Dollar’s move today, we’d monitor the actions in EUR/USD, GBP/USD, USD/CHF and USD/JPY together to confirm the moves of each other. To be specific, the ranges to breakout from are 1.1185/1.3820 in EUR/USD, 1.3158/1.3351 in GBP/USD, 0.9156/0.9372 in USD/CHF and 112.52/115.51 in USD/JPY.

In Japan, at the time of writing, Nikkei is up 0.05%. Hong Kong HSI is down -0.04%. China Shanghai SSE is down -0.15%. Singapore Strait Times is down -0.26%. Japan 10-year JGB yield is down -0.0007 at 0.050. Overnight, DOW dropped -0.30%. S&P 500 dropped -0.75%. NASADAQ dropped -1.14%.

Australia Westpac consumer sentiment dropped to 104.3, different responses between states

Australia Westpac-Melbourne Institute consumer sentiment dropped -1.0% to 104.3 in December, staying in positive territory where optimists outnumber pessimists. Nevertheless, responses from states are rather different, with both NSW and Victoria posted significant falls (down 3.6% and 3.5% respectively) while sentiment was up in Queensland (3.4%), WA (3.2%) and SA (7.1%).

Westpac added that RBA’s meeting on February 1 will be a very important one with new economic forecasts. No action or commitment on interest rate is expected at the meeting yet. But RBA would lower the bond purchase pace from AUD 4B per week to AUD 2B per week.

BoJ Kuroda: Consumer inflation will approach target through various channels

BoJ Governor Haruhiko Kuroda told parliament today, “it’s true there’s a chance consumer inflation will approach 2% through various channels.”

“But what’s desirable is for the economy to recover steadily and push up corporate profits, thereby leading to higher wages and inflation,” he added. “We’ll patiently maintain ultra-easy policy to achieve this at the earliest date possible.”

Kuroda also said Japan is not in a state of “stagflation”.

China industrial production rose 3.8% yoy in Nov, retail sales rose 3.9% yoy

China industrial production rose 3.8% yoy in November, matched expectations. That’s a slightly faster growth rate than October’s 3.5% yoy. Retail sales rose 3.9% yoy, below expectation of 4.9% yoy, and slowed from prior month’s 4.9% yoy. Fixed asset investment rose 5.2% ytd yoy, slightly below expectation of 5.3%.

“Generally speaking, the national economy maintained the recovery momentum in November, and the major macro indicators stayed within a reasonable range,” the NBS said in its statement. “However, we must note that the international environment is increasingly complex and severe, and there are still many constraints on the domestic economic recovery.”

Fed to speed up tapering, publish new dot plot

Fed Chair Jerome Powell has clearly indicated that there will be a discussion about accelerating the tapering pace, and ending the asset purchases a a few months early. We’d expect Fed to announce a decision today, probably a double in the size of tapering to USD 30B per month.

The main focus will be more on the new economic projections, in particular the dot plot. Back in October, nine policy makers penciled in one rate hike or more in 2022 (six expected one hike and three expected two hikes), while nine expected no change. We’d probably see the interest rate projections shift even more towards the hawkish side.

Here are some suggested previews:

Looking ahead

UK CPI and PPI are the main focus in European session. Later in the day, Canada will also released CPI. US will release Empire State manufacturing, retail sales, import prices, business inventories and NAHB housing index. But of course, all focuses will be on FOMC.

USD/CAD Daily Outlook

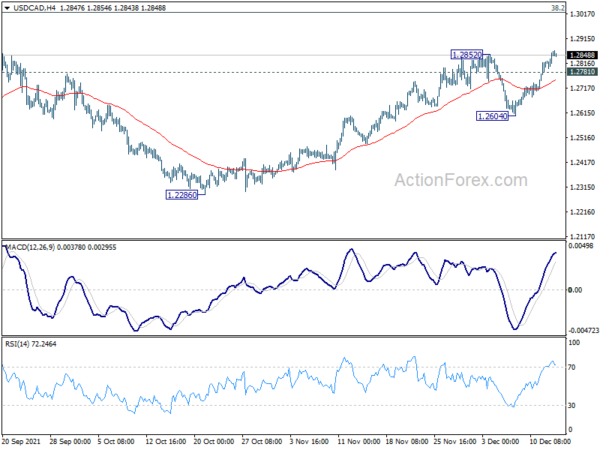

Daily Pivots: (S1) 1.2820; (P) 1.2842; (R1) 1.2887; More…

USD/CAD’s break of 1.2852 confirms resumption of rise from 1.2286. Intraday bias stays on the upside for 1.2947 resistance next. Firm break there will target 1.3022 key medium term fibonacci level. On the downside, below 1.2781 minor support will turn intraday bias neutral first. But near term outlook will stay mildly bullish as long as 1.2604 support holds, in case of retreat.

In the bigger picture, focus will be on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. On the downside, however, break of 1.2286 will turn focus back to 1.2005 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q3 | -8.30B | -8.02B | -1.40B | -1.54B |

| 23:30 | AUD | Westpac Consumer Confidence Dec | -1.00% | 0.60% | ||

| 02:00 | CNY | Retail Sales Y/Y Nov | 3.90% | 4.90% | 4.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Nov | 5.20% | 5.30% | 6.10% | |

| 02:00 | CNY | Industrial Production Y/Y Nov | 3.80% | 3.80% | 3.50% | |

| 04:30 | JPY | Tertiary Industry Index M/M Oct | 1.50% | 1.20% | 0.50% | |

| 07:00 | GBP | CPI M/M Nov | 0.50% | 1.10% | ||

| 07:00 | GBP | CPI Y/Y Nov | 4.70% | 4.20% | ||

| 07:00 | GBP | Core CPI Y/Y Nov | 3.80% | 3.40% | ||

| 07:00 | GBP | RPI M/M Nov | 0.30% | 1.10% | ||

| 07:00 | GBP | RPI Y/Y Nov | 6.70% | 6.00% | ||

| 07:00 | GBP | PPI Input M/M Nov | 1.10% | 1.40% | ||

| 07:00 | GBP | PPI Input Y/Y Nov | 11% | 13% | ||

| 07:00 | GBP | PPI Output M/M Nov | 0.80% | 1.10% | ||

| 07:00 | GBP | PPI Output Y/Y Nov | 7.30% | 8.00% | ||

| 07:00 | GBP | PPI Core Output M/M Nov | 0.40% | 0.70% | ||

| 07:00 | GBP | PPI Core Output Y/Y Nov | 7.10% | 6.50% | ||

| 13:15 | CAD | Housing Starts Y/Y Nov | 240.0K | 236.6K | ||

| 13:30 | CAD | Manufacturing Sales M/M Oct | 4.00% | -3.00% | ||

| 13:30 | CAD | CPI M/M Nov | 0.70% | 0.70% | ||

| 13:30 | CAD | CPI Y/Y Nov | 4.80% | 4.70% | ||

| 13:30 | CAD | CPI Common Y/Y Nov | 1.90% | 1.80% | ||

| 13:30 | CAD | CPI Median Y/Y Nov | 2.90% | 2.90% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Nov | 3.30% | 3.30% | ||

| 13:30 | USD | Empire State Manufacturing Index Dec | 27 | 30.9 | ||

| 13:30 | USD | Retail Sales M/M Nov | 0.80% | 1.70% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Nov | 1.00% | 1.70% | ||

| 13:30 | USD | Import Price Index M/M Nov | 0.70% | 1.20% | ||

| 15:00 | USD | Business Inventories Oct | 0.90% | 0.70% | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 83 | 83 | ||

| 15:30 | USD | Crude Oil Inventories | -1.8M | -0.2M | ||

| 19:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 19:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals