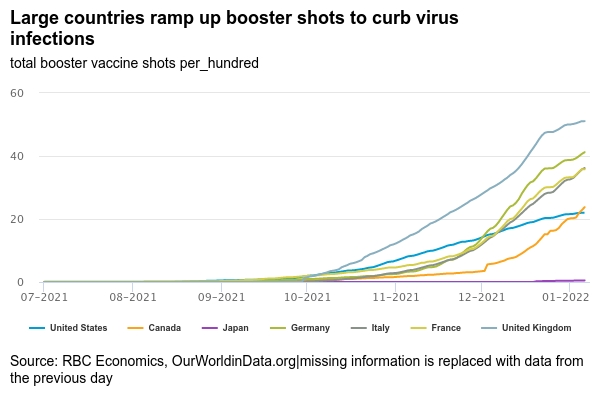

A quiet economic calendar for Canada next week will keep the focus on virus developments. Provincial governments have re-introduced measures to slow virus spread, including mandated closures of high-contact services like restaurant dining rooms and gyms in Ontario and Quebec. We expect businesses within the travel and hospitality sectors to continue to bear the brunt of restrictions. Indeed, our card spending data already indicated a sharp decline in travel spending in December. And the exceptionally high rate of virus spread has probably pushed a large share of the workforce into self-isolation, adding to near-term labour supply issues in other sectors. All told, we expect Q1 GDP to look decidedly softer and have revised our growth projection to 1.5% from 4% for the quarter. With testing capacity overwhelmed in many regions, hospitalization rates will be carefully scrutinized for a sense of how quickly restrictions could be eased. This latest wave of COVID-19 is multiples larger than those that preceded it. But the speed of the spread means it’s also expected to run its course more quickly, we expect growth in the economy to bounce back in Q2.

Inflation data will remain a key issue in the United States, with CPI growth expected to tick above 7% on a year-over-year basis. That would be up from 6.8% in November—which was already the highest since the 1980s. Pandemic distortions continue to bias annual price growth higher compared to pre-pandemic levels, with used car and gasoline prices accounting for a disproportionate share of gains. But even controlling for those factors, price pressures have broadened. Central banks have been largely looking through expected near-term Omicron economic impacts and remain focused on both those price pressures and firming labour markets. We do not expect the latest wave of virus spread to prevent the US Fed (or the Bank of Canada) from hiking interest rates in the first half of this year.

Week ahead data watch:

United States CPI: Year-over-year price growth is expected to rise to 7.1% from 6.8% in November underpinned by higher used car prices. We also expect evidence of broadening price growth to continue in December.

US retail sales are expected to tick lower in December on lower auto and gasoline station sales. Retail sales remain very firm relative to pre-pandemic trends.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals