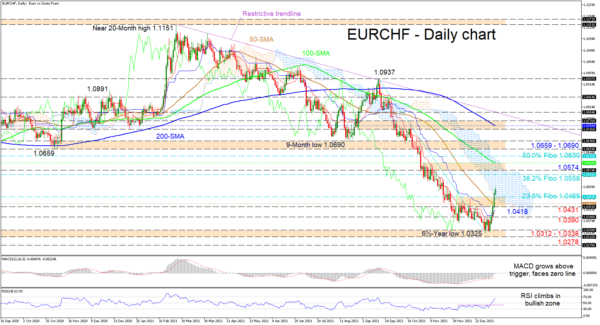

EURCHF buyers have dominated ever since touching a 6½-year low of 1.0325, plotting four consecutive green candles, which has steered the price above the 50-day SMA of 1.0442 and the 1.0469 level, which is the 23.6% Fibonacci retracement of the down leg from 1.0937 until 1.0325. Despite the latest climb in the price, the SMAs are still sponsoring the negative trend in the pair.

The Ichimoku lines are indicating that an upside drive is countering the bearish bias, while the short-term oscillators are reflecting that the bulls have gained the upper hand. The MACD, is strengthening above its red trigger line and looks set to prod north of the zero threshold, while the RSI is heading for the 70 overbought level.

If the pair continues to claw in additional lost ground, preliminary upside constraints could arise from the 38.2% Fibo of 1.0558 ahead of the resistance zone from the 1.0574 barrier until the 100-day SMA at 1.0604. Should the pair overcome the cloud, buyers may then tackle the 50.0% Fibo of 1.0630 prior to challenging the key 1.0659-1.0690 boundary (previous support-now-resistance), which extends back to November 2020.

Alternatively, if sellers resurface, an initial support zone could develop between the 23.6% Fibo of 1.0469 and the 1.0431 obstacle. Diving lower, the Ichimoku lines may delay the test of the 1.0390 barrier and the support section of 1.0312-1.0338. Should the latter barricade, which includes the 6½-year low give way, the bears could then target the 1.0278 trough from the end of May 2015.

Summarizing, EURCHF is exhibiting a bearish bias below the 1.0600 handle, and specifically the 1.0574-1.0604 resistance area. Nevertheless, buyers are currently dominating and have yet to show any signs of weakness.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals