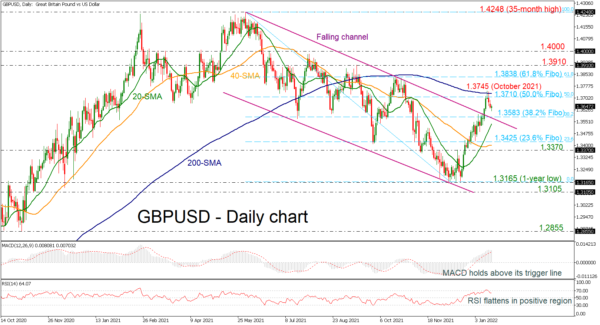

GBPUSD is reversing following the advance to the 1.3745 level, which represents a nearly three-month high. Although the price declined following the touch of the 200-day simple moving average (SMA), it remains above the long-term declining channel. The MACD oscillator is still holding above its trigger line in the positive region with weak momentum, while the RSI is flattening above the neutral threshold of 50.

If the pair continues to fall, immediate support might be found near the 38.2% Fibonacci retracement level of the decline from 1.4248 to 1.3165 at 1.3583, before meeting the 20-day SMA at 1.3535. If selling pressure remains, traders may consider the 23.6% Fibonacci level of 1.3425, which is located above the inside swing high of 1.3370 and the one-year low of 1.3165.

In the alternative scenario, a rally above recent highs could take the currency to the 61.8% Fibonacci level of 1.3838 and then to the 1.3910 barrier. Even higher, the psychological number of 1.4000 may put an end to bullish moves.

All in all, GBPUSD has largely maintained a bullish bias since the bounce from 1.3165, although the recent bearish days may portend a negative correction.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals