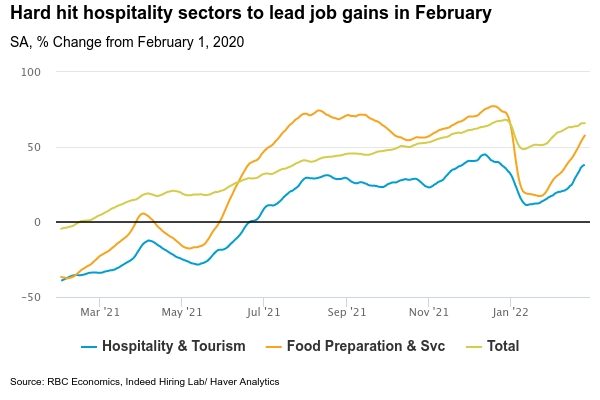

We expect Canada’s job market to have posted a strong comeback from the latest pandemic wave. We expect February’s job report will retrace three-quarters of the 200,000 jobs lost in January. High-contact hospitality sectors again took the brunt of the hit from Omicron, as did regions (Ontario and Quebec) that imposed more aggressive restrictions. But virus spread and containment measures have now eased. Early data on restaurant bookings and our own tracking of card transactions is pointing to a rapid rebound in spending in February—and job postings have bounced back sharply. Hours worked are also expected to climb after falling 2.2% in January due to elevated worker absenteeism. With the economic impact of the virus fading, labour shortages will remain a more pressing issue for many businesses than a lack of orders. Indeed, high demand for workers and shrinking numbers of unemployed people mean wages are likely to rise.

Record household net wealth, driven by rising home prices and stock market gains, are expected in the Q4 Canadian household balance sheet Friday. The closely-watched debt-to-income ratio likely surged to well above pre-pandemic levels—fueled by higher debt levels and a return to more normal disposable incomes as government pandemic support tapered off. Most pandemic debt growth has come from mortgages financed at low interest rates. So even as debt loads edged higher in Q4, payments associated with them likely remained at low levels. To be sure, financial markets have been rocked in Q1 by the Russian invasion of Ukraine. But households are buttressed by a large amount of savings accumulated over the course of the pandemic. And strengthening job markets are expected to push disposable incomes even higher.

Week ahead data watch:

- Canadian merchandise trade will likely move into surplus (0.5B) as higher oil prices (which increased 16%) lifted exports—but the strong gain in imports of communication equipment in December won’t be repeated.

- United States inflation is expected to have jumped higher to 7.7% on a year over basis as consumers paid more at the pump (+40%). We also expect to see evidence of price pressures broadening.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals