The British pound returned to the $1.3000 area, a significant circular level from which the British currency bounced in the middle of last month. The bulls continue to hold for the second consecutive trading session. The intraday charts clearly show buying impulses when going under the psychologically crucial round level.

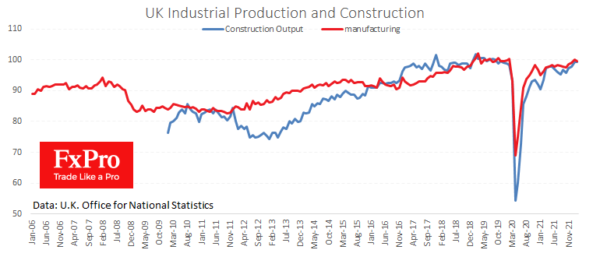

A fresh batch of UK statistics sets the mood that the local rebound might be temporary. The economy added 0.1% in February compared to 0.8% a month earlier and was twice as weak as expected. Industrial production fell by 0.6% compared to an expected 0.3% increase. This demonstrates the damage to business activity in sectors that are often one step ahead of the economic cycle.

A sharp slowdown in the economy will reduce the room for monetary policy tightening by the Bank of England.

The decline in stock markets also plays into the hands of pound sellers, which positively correlates with demand for risky assets. GBPUSD went into a spike on events around Ukraine, losing more than 4.5% from late February to the lows of March. The subsequent rebound failed to gain traction, stalling near the 61.8% level of the initial decline. A consolidation under 1.3000 potentially paves the way to 1.26 (161.8% level).

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals