WTI oil edges lower on Friday, pressured by prospects of weaker global growth and higher interest rates, as the International Monetary Fund cut its global economic growth forecast and Fed Chair Powell signaled that half percentage point rate increase will be on the table in central bank’s next policy meeting in May.

New Covid lockdowns in China hurt demand outlook from the world’s biggest oil importer and so far offsetting threats of EU’s ban on Russian oil that would further tighten oil supply.

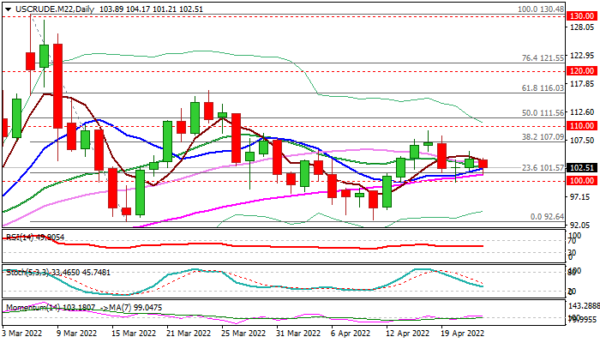

Fresh weakness emerged after the recovery action penetrated daily cloud (spanned between $103.49 and $110.26) but failed to hold within the cloud.

Near-term action is holding between $101.57 (broken Fibo 23.6% of $130.48/$92.64) and $107.09 (Fibo 38.2%) with lower range boundary being under pressure again, after previous attempts repeatedly failed to register close below this level.

Mixed daily studies lack clearer direction signal, which could be expected on firm break of supports at $101.57/$100.00 (Fibo / psychological) that would bring bears in play and risk deeper fall.

Daily Kijun-sen ($104.76) marks pivotal barrier, break of which would ease downside pressure.

Res: 104.17; 104.76; 105.39; 107.09

Sup: 101.57; 101.21; 100.00; 98.54

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals