Summary

In our April International Economic Outlook, we highlighted how China’s commitment to its “Zero-COVID policy is a key theme as well as a major risk to the 2022 global economic outlook. Lockdowns, in our view, make China’s official GDP target of 5.5% unreachable, and we forecast China’s economy to grow 4.5% this year. However, risks around that forecast are tilted to the downside, which in turn, tilts global growth prospects to the downside as well. Given China’s stature within the global economy, negative local developments tend to cause ripple effects across the emerging markets. In this report, we update our China Sensitivity Analysis and determine that most of the larger and systemically important emerging economies are sensitive to developments in China. Should China’s economy decelerate more than we currently forecast and contagion risks materialize the way our framework suggests, this year could mark the slowest pace of global expansion since the aftermath of the Global Financial Crisis in 2009.

China Contagion To Be Felt Globally and Locally

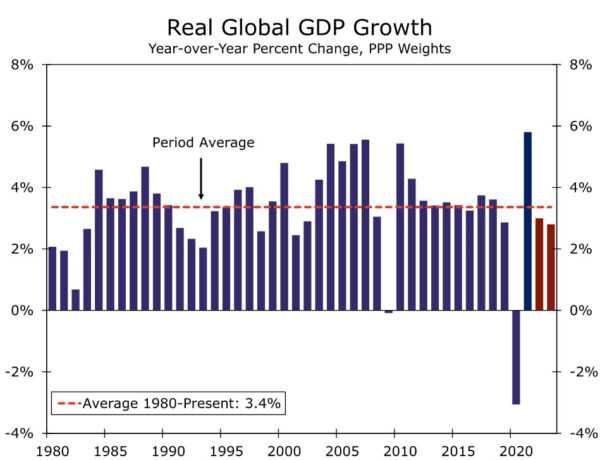

In our April International Economic Outlook, we noted how COVID-related developments in China have become a key theme as well as a major risk to the 2022 global economic outlook. Chinese authorities commitment to the Zero-COVID policy will likely weigh heavily on local economic activity, and in turn, we believe could have an impact on 2022 global GDP prospects. We also highlighted in our April Economic Outlook that China’s official 2022 GDP target of 5.5% is, in our view, unlikely to be reached. We believe the combination of harsh COVID lockdowns, poor sentiment toward China’s financial markets, and a still deteriorating real estate sector should result in China’s economy growing 4.5% this year. Assuming our forecast is accurate, excluding 2020 due to the initial impact of COVID, China’s economy could grow at the slowest pace since the aftermath of the Tiananmen Square protests in 1990. The economic deceleration in China is one of the key drivers of our revised, and more pessimistic, outlook for global GDP growth. Given the economic slowdown in China, and also the collapse in Russia’s economy as well as subsequent impacts from the war in Ukraine, we no longer expect the global economy to grow at an above trend rate this year. We now forecast the global economy to grow just 3% in 2022, well below the consensus forecast of 3.5%, and below the IMF’s latest updated forecast of 3.6%.

In our view, China’s growth prospects are still tilted toward slower growth than our 4.5% target, which could mean an even slower pace of global growth as well. The COVID outbreak has spread to Beijing, and while mass testing protocol has been implemented, citywide lockdowns have been avoided. Beijing lockdowns are still possible, and even though infections have somewhat stabilized in Shanghai, the timing around when current restrictions could be lifted is uncertain. Slower China GDP growth in isolation would likely have negative repercussions for global economic growth; however, a decelerating Chinese economy tends to result in contagion across the emerging markets, and these potential ripple effects worry us. There are many emerging market economies that are tightly connected to China via trade linkages, and could experience their own growth slowdowns via reduced demand or supply chain disruptions. In addition, a growth slowdown in China typically leads to elevated volatility in local asset prices. This financial market volatility has already started in China, but is spreading across the emerging markets. Should China’s economy deteriorate further, we would expect the recent weakness across emerging market currencies and fall in local equities to pick up pace. Weak currencies could prompt central banks to extend monetary tightening cycles in an effort to defend the value of their currencies, which could dampen local growth prospects. Declining equity prices could keep consumers on the sidelines, and result in softer consumption and overall output.

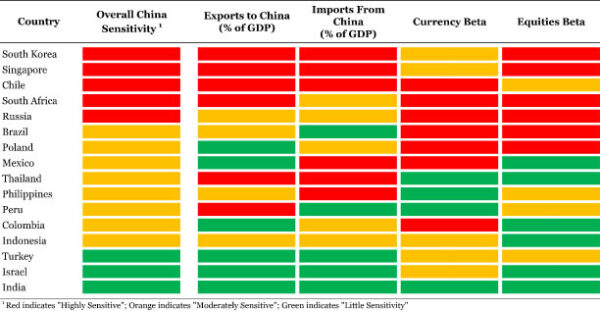

Against this backdrop, we have updated our China sensitivity analysis to determine how sensitive emerging market countries are to China, and how global GDP growth could be impacted. Our table includes indicators such as exports to China as a share of GDP as well as emerging market currency and equity betas (i.e.: a statistical measure of sensitivity) to the renminbi and Shanghai composite equity index. In this update, we also include import exposure from China as a share of GDP. While always large, China’s role as a major supplier and exporter has risen over the past two years. Now that new lockdowns have been imposed in Shanghai as well as port cities, prolonged and renewed supply chain disruptions could occur. As we have seen over the past two years, supply chain disruptions could have negative growth implications, especially for countries that import a sizable amount of goods from China.

April 2022: China Sensitivity Update

Our framework reveals that many of the larger and more systemically important emerging market countries are very sensitive to China. In that sense, looking at the “Overall China Sensitivity” column of the table below, our framework identifies South Korea, Singapore, Chile, South Africa and Russia as “Highly Sensitive” to China. As a reminder, a red box indicates a country is “Highly Sensitive” to each indicator, while an orange suggests “Moderately Sensitive” and a green “Little Sensitivity”. In the case of the “Highly Sensitive” countries, with the exception of Russia, all of these countries are heavily dependent on Chinese demand. Exports to China make up a sizable chunk of each country’s GDP, and should a more material China slowdown occur, these countries would likely see the export component of their economies soften sharply. While technically, lower imports should boost a country’s overall output, with lockdowns spreading and supply chains still fragile, imports from China could be a vulnerability. Long lead times could disrupt value chains and delay the creation of end products. In that sense, reliance on imports from China for critical components could act as a drag on an economy’s GDP as well. Most of the “Highly Sensitive” countries are reliant on imports from China, with South Africa and Russia being the exceptions.

Local financial markets in each “Highly Sensitive” country also respond to moves in China’s asset prices if we look at the “Currency Beta” and “Equities Beta” columns. As far as how the betas work, for example, a beta of +0.66 for the Korean won means that when the Chinese renminbi moves 1%, the Korean won tends to move 0.66% in the same direction. So, if the renminbi depreciates 1%, the Korean won should weaken 0.66% on average. The same logic applies for the equities beta as well. Most of the overall “Highly Sensitive” countries have elevated betas, meaning their currencies and equity indices are likely to experience extreme volatility in the event China’s currency and local equities selloff. These countries could find themselves in a position where their central banks have to tighten monetary policy aggressively to defend the value of their currencies, which should weigh on local GDP growth. On the other hand, a selloff in equities could disrupt spending patterns via sentiment if consumers get nervous about their household finances. Lower consumption would be another potential drag on GDP growth across each of these countries.

Countries our framework identifies as “Moderately Sensitive” to China are also some of the larger and economically important developing economies. Again looking at the “Overall China Sensitivity” column, countries such as Brazil, Poland and Mexico may be “Moderately Sensitive”, but by no means are their economies not insignificant contributors to global growth. Further down the column, the economies of Peru, Colombia and Indonesia are also somewhat sizable in a global context. India, however, is arguably one of the most significant developing market contributors to global growth. Our framework suggests India’s economy is relatively insulated from developments in China’s economy and local financial markets, and may not be as affected. India has small trade linkages with China and is not reliant on Chinese demand, nor does the country source a sizable amount of imports from China. In addition, the Indian rupee and Sensex equity index are not influenced by volatility in China’s local financial markets. While not as large or systemically important as India, the same dynamics exist in Israel and Turkey. Both the Israeli and Turkish economies do not have material trade linkages to China, while neither the shekel nor lira are particularly influenced by movements in the renminbi or Shanghai equity index. In that context, our framework suggests Israel and Turkey are also relatively isolated from China.

Watch Out For Global Growth of Just 2.6%

As mentioned, we believe China’s growth prospects are tilted to the downside. We acknowledge President Xi’s comments that authorities will do more to support growth; however, with COVID-related lockdowns still in place and possibly extending to more parts of the country, we are skeptical monetary and fiscal support will be as effective under lockdown conditions. In our view, a China growth deceleration to 4% is not out of the question. As of now, this is a downside risk scenario, not our base case forecast, but nevertheless an entirely plausible outcome. China’s economy slowing to 4%, all else equal, would likely bring global GDP growth below 3% this year. However, including the potential contagion effects on other emerging market economies and financial markets, the global economy could slow even further below trend than we already forecast.

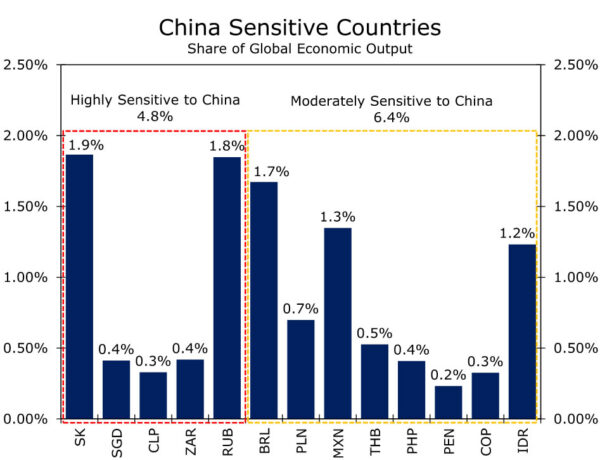

The countries our framework identifies as “Highly Vulnerable” account for almost a 5% share of global economic output, and “Moderately Vulnerable” countries account for almost 6.5% (Figure 2). Together, these countries make up a sizable percentage of global economic output, so much so that if the China ripple effects materialize the way our analysis suggests, the shock to global growth could be significant. In our view, the impact from China directly as well as its contagion on other emerging market countries could trim between 0.3% and 0.4% off global GDP growth. That could result in the global economy growing just 2.6% this year. A 2.6% global growth rate would be well below the longer-run average growth rate of 3.4% for the global economy (Figure 3). Also, aside from the COVID-induced global recession in 2020, 2.6% growth would mark the slowest pace of global expansion since the aftermath of the Global Financial Crisis in 2009.

As mentioned, this scenario represents a downside risk to our global economic outlook. Going forward, we will be closely monitoring high frequency indicators of how China’s economy is responding to lockdown protocol, but also focusing on hard data to gauge how the real economy is being impacted. April PMI data will be an important indicator as these data will capture the entire lockdown to date, and will be the first significant data releases of Q2. We expect the PMIs to fall further into contraction territory, but will be focused on how deep into contraction, as well as the underlying details for clues on whether supply chains are being impacted. We will also be focused on the PBoC operations, particularly daily renminbi fixings. PBoC actions should provide insight into whether the central bank is comfortable with a weaker renminbi or whether authorities prefer to limit the extent of renminbi depreciation. For now, we believe PBoC officials will side with allowing for more renminbi depreciation and believe they are still comfortable accommodating a weaker currency to act as a shock absorber and support the economy. We also believe the PBoC will cut the Reserve Requirement Ratio (RRR) again in Q2 and possibly lower lending rates. Easier PBoC monetary policy, especially at a time when the Federal Reserve is raising interest rates, should place additional depreciation pressure on the renminbi, and believe the USD/CNY and USD/CNH exchange rates can end this year at CNY6.66 and CNH6.66 respectively.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals