Whilst the COT report shows us traders were their most bearish on CHF futures in 6-months, recent events and price action suggest some of those bears have closed out.

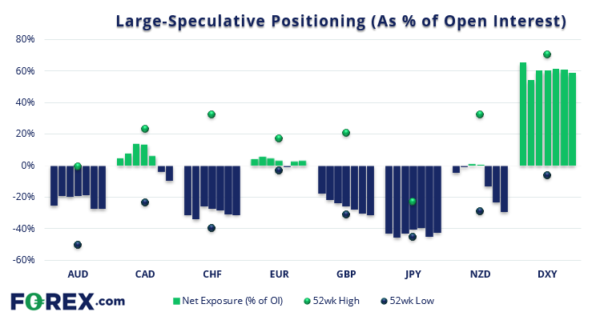

Commitment of traders (as of Tuesday 17th May 2022):

- The weekly change for FX majors were relatively low, and all beneath +/- 10,000 contracts

- Net-long exposure to Mexico Peso futures rose to an 11-week high

- Traders were their most bearish on Swiss franc futures since November

- Large speculators were their most bearish on NZD futures since the Pandemic in March 2020

Swiss franc futures (CHF):

Net-short exposure to Swiss franc futures were at their most bearish level in over 6-months, as of Tuesday last week. Gross shorts were at a 17-week high, although gross longs have been ticking higher in recent weeks. And we think we know why. The SNB have signalled to markets they can cope with a stronger currency (within reason) and suggested they may finally hike rates from the floor of -0.75%, should inflation continue to beat expectations. And hawkish comments from SNB (Swizz National Bank) on Thursday saw USD/CHF plummet during its most bearish session in nearly six years. So bearish are clearly capitulating at these lows, and we see the potential for the move continue over the coming week/s as the SNB get forced to finally hike rates.

Commitment of traders (as of Tuesday 17th May 2022):

- Large speculators trimmed net-long exposure to gold futures for a fifth consecutive week

- Net-long exposure to silver futures fell for a fourth consecutive week

- Traders were their most bearish on WTI futures in two months

- Exposure to copper futures were trimmed for a second consecutive week

Gold futures:

Large speculators trimmed net-long exposure to gold futures for a fifth consecutive week. This is a pattern echoes for managed funds (who tend to use leverage). In fact, managed funds have lowered gross longs 8 out of the past 10 weeks, and increased gross shorts for 8 consecutive weeks, which has dragged net-long exposure of fund managers down to their least bullish level since October. With that said, gold rebounded following a false break of 1800 and rose to a high of 1865 after today’s Asian open. If it can break above there, we see the potential for a move to 1880 – 1900, so long as prices can hold above 1820.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals