With inflation soaring, the U.S. Federal Reserve is widely expected to hike its target rate by another 50 basis points, taking it into the 1% range). And it’s not done yet. This morning’s May inflation numbers were once again above expectations, with year-over-year CPI growth hitting a new multi-decade high of 8.6%. With unemployment at the rock-bottom level of 3.6% in May—and almost twice as many job openings as job seekers—inflation is taking clear precedent over any growth concerns. Indeed, Chair Powell has emphasized his commitment to “expeditiously” address inflation.

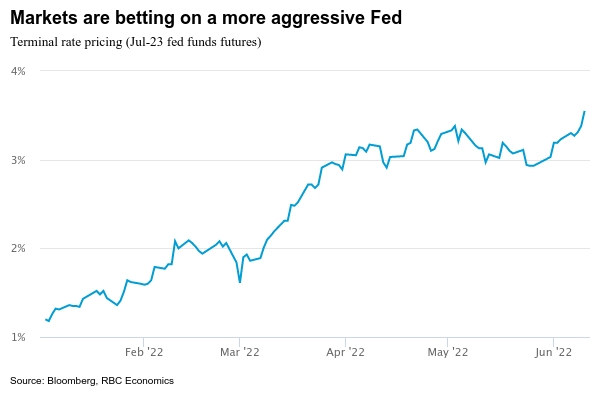

How high will rates have to go to accomplish that goal? For now, consumer demand remains very strong. Retail sales likely ticked lower in May with lack of supply again weighing on auto sales. But purchases have been running well above pre-pandemic levels and spending on services (largely not counted in the retail numbers) has continued to recover as the economic impact of the pandemic eases. We expect another 50 basis point hike at the next fed policy meeting in July on the way up to a 2.75% to 3% range by the end of the year. Slower growth in the economy is expected to follow against the risk that more aggressive rate hikes than we expect will be needed to tame inflation pressures that continue to stoke recession fears. Markets will be watching updated policy rate expectations from FOMC members. As of March, most members did not expect to hike rates above 3%, but that share likely moved higher.

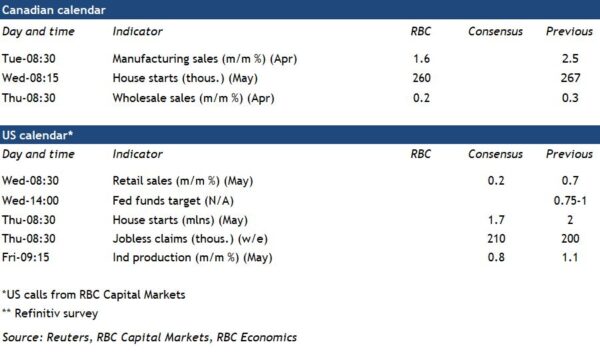

Week ahead data watch:

In May, U.S. industrial production is expected to continue to grow on a month-over-month basis, though at a slower pace. Hours worked in manufacturing ticked lower in May, while mining sector hours ticked higher (up close to 3%).

U.S. retail sales are expected to fall month-over-month in May, as weakness in motor vehicle parts sales offset higher gasoline prices.

The already released flash Canadian manufacturing sales report showed a 1.6% month-over-month increase in May, boosted by higher petroleum and coal prices and increased motor vehicle sales.

Wholesale sales in Canada are expected to remain largely in line with April levels, matching the advance estimate from Statistics Canada

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals