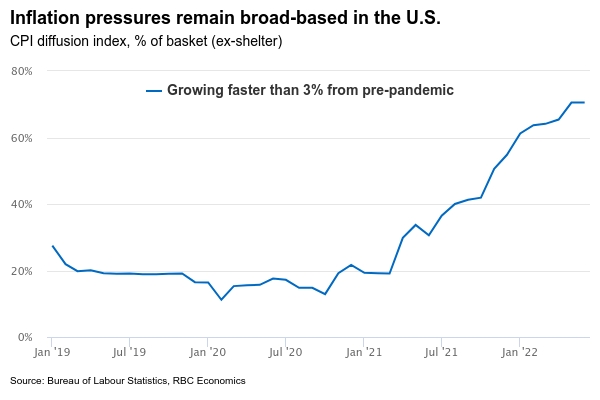

U.S. inflation numbers are expected to edge lower next week, dropping to 8.8% in July. The slowdown (the reading was at 9.1% in June) comes after inflation hit record levels following more than a year of persistent supply chain pressures, elevated domestic demand and soaring commodity prices. The dip will likely reflect an easing in gasoline price growth on lower oil prices. By contrast, the year-over-year growth in food prices probably didn’t change much, with core (ex-food & energy) prices edging a bit higher compared to a year ago. Broader measures of price inflation are still very high. Over 70% of items in the consumer basket (excluding shelter) were growing faster than 3% in June.

There are reasons to believe that inflation will continue to slow. Global supply chain pressures have eased more sustainably since late spring, as shipping times and costs fall. Commodity prices, though very high, have also been trending lower. And with high inflation and rising borrowing costs squeezing consumers’ real buying power, there are already early signs of slowing domestic consumer demand. Goods purchases in volume terms have fallen in recent months, to 3% below levels a year ago in June.

Still, spending on services, especially those that are leisure and travel related, will remain strong over the summer. Rent prices having increased more substantially over the past months are also expected to strengthen further. A bigger pullback in consumer demand will likely be necessary to get inflation moving back toward the Federal Reserve’s 2% target rate. Overall, we look for the Fed to hike rates to 3.25% – 3.5% range by end of this year

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals