Recovery picks up on Friday and cracks 1.01 barrier, driven by a hawkish stance from the ECB, following central bank’s decision to raise interest rates by 75 basis points and remaining on track for further tightening, along with weaker dollar, dented by tough rhetoric from Japan, warning about intervention to stop the free fall of yen.

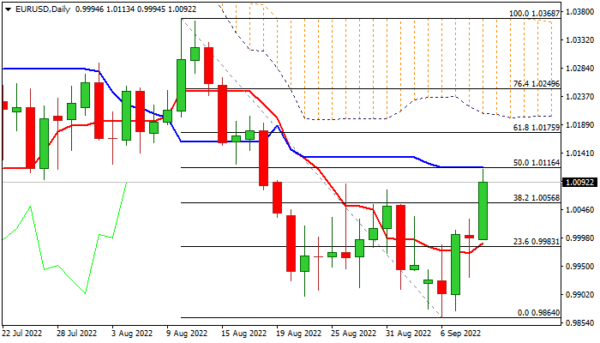

Strong rise of bullish momentum on daily chart and break above pivotal Fibo barrier at 1.0056 (38.2% 1.0368/0.9864) underpin the action, which faces headwinds from daily Kijun-sen (1.0116).

Bulls need to register a weekly close above Aug 26 spike high at 1.0089 to keep positive bias for extension towards daily cloud base (1.0201).

Caution on return and close below 20DMA (1.0016) that would signal possible recovery stall.

Res: 1.0116; 1.0154; 1.0173; 1.0201.

Sup: 1.0056; 1.0016; 1.0000; 0.9983.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals