U.S. Review

A Tough Week

- The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood and magnitude of additional Fed accommodation.

- The bond market now expects almost four Fed rate cuts by the end of the year, but one might rightly wonder how lower shortterm rates would alleviate supply chain disruptions.

- We believe the Fed will try to remain patient, and look for a “material” change in the outlook, but if and when the committee decides it needs to ease again, it most likely won’t be just once.

A Tough Week

The COVID-19 coronavirus hammered financial markets this week and rapidly raised the perceived likelihood of additional Fed accommodation. The S&P 500 fell close to 14% as worsening outbreaks in South Korea and Japan (where schools have been closed) and in northern Italy (the first advanced Western economy to have a major outbreak), drove volatility to the highest level since December 2018. Moreover, the wave of fear and risk-off moves drove the U.S. ten-year yield to an all-time low this week, while corporate bond spreads are rising rapidly. Clearly, financial conditions are tightening, and threaten to choke off economic growth beyond the direct effects of the coronavirus.

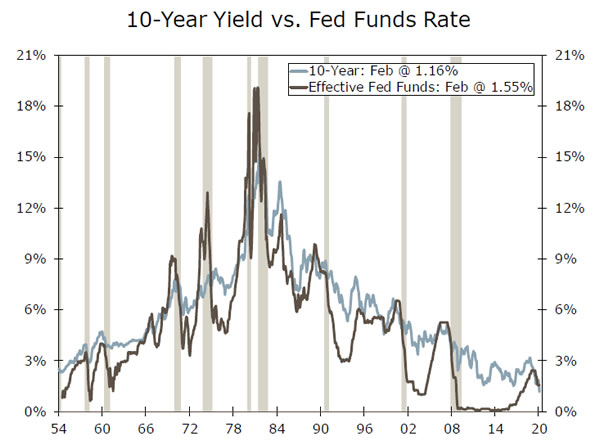

The bond market now expects almost four Fed rate cuts by the end of the year, but one might rightly wonder how lower short-term rates would alleviate supply chain disruptions and aversion to international travel. Prior to the last major financial market flare-up, in December 2018, one could make the case that short-term rates were overly restrictive. Today it is hard to make that same case, after the 75 bps of easing the Fed delivered last year after reversing course. We believe the Fed will try to remain patient, and look for a “material” change in the outlook—based on hard data—before cutting again. Dallas Fed President Robert Kaplan stated on Tuesday that the Fed is “a number of weeks away from being able to make the judgment,” while Vice Chairman Richard Clarida said “it is still too soon to even speculate about either the size or the persistence of these effects.” The next FOMC meeting is on March 18. We expect the Fed to remain on hold then, but it will certainly signal it’s closely watching downside risks, both in its new dot plot and in its rhetoric.

If and when the committee decides it needs to ease again, it most likely won’t be just once. The FOMC has launched six easing cycles in the past thirty years, and each time was at least 75 bps. In short, it is entirely possible the Fed delivers three rate cuts for the second year in a row—the first time in response to the trade war and slowing global growth and the second in response to a viral epidemic. Yet despite the bond market’s conviction, it is impossible to say with certainty what will happen. We cannot predict the spread of the virus, but news headlines and financial markets will certainly try. For now, at least, patience is perhaps the best option.

The new economic data this week were actually fairly positive, but we add extra emphasis to the usual caveat that nearly all economic data are lagging. Nondefense capital goods orders rose 1.1% in January, pulling the three-month annualized rate up to the highest since the trade war flared up in August. Yet just as the Phase I trade deal provided relief to the lagging manufacturing sector, COVID- 19 emerged as its latest scourge.

Consumer confidence rose to a six-month high, but frightening images from abroad should weigh against a historically strong labor market in coming weeks. Personal income rose 0.6% in January while personal spending rose 0.2%. New home sales set a cycle high, and housing should continue to strengthen, with mortgages rates at record lows and likely to stay there, particularly if the bond market’s forecast of lower rates pans out.

U.S. Outlook

ISM Manufacturing • Monday

After months of heightened trade tensions, producers got a brief reprieve with the signing of the U.S.-China Phase I trade deal in January. While purchasing managers continued to cite tariffs as a concern in last month’s ISM manufacturing survey, the de-escalation was enough to push the index above 50 for the first time in five months. As trade tensions receded, the spread of COVID-19 has emerged as a new headwind for the manufacturing sector. Factory shutdowns in China and other efforts to contain the virus are likely to disrupt manufacturing in the United States. It is less clear, however, exactly when we will begin to see an effect in the data.

Regional Fed manufacturing surveys for February have not indicated much disruption, though most of these surveys only reflect conditions through the earlier part of the month. We anticipate the index will be able to hold its gains in February, but we will be reading closely for signs of virus-induced disruptions.

Previous: 50.9 Wells Fargo: 51.0 Consensus: 50.5

ISM Non-Manufacturing • Wednesday

The Markit services PMI dropped to the lowest point in its relatively short history in February. This preliminary print could be revised up, but it has certainly heightened interest in this month’s ISM nonmanufacturing report. The indices are not identical, but both help gauge economic activity in the service sector, and signs of weakness in the service sector warrant close attention. The service sector accounts for the bulk of employment and has been a key driver of growth amid weakness in the manufacturing sector. Fortunately, outside the drop in the Markit index there does not appear to be many signs of strain in the service sector, and we anticipate the index will remain around its January level.

These survey metrics and their forward-looking components are likely to offer the first signs of potential business impact from the coronavirus. However, the domestic nature of the service sector should isolate it from disruptions abroad to some extent.

Previous: 55.5 Wells Fargo: 55.4 Consensus: 55.0

Employment Report • Friday

The labor market started the year off strong with employers adding 225K jobs in January. The headline figure was flattered by large jumps in hiring for construction and leisure & hospitality due to unseasonably mild weather, though the underlying trend remained strong. Employers have added an average of 206K jobs over the past six months, and most labor market data for February suggest the healthy rate of job growth should continue. Initial jobless claims have moved back toward their 50-year low after spiking in December, and the Conference Board’s survey of consumers shows a healthy proportion still see jobs as plentiful. On top this, Census hiring continues to ramp up. The past two Februarys of Census years, there was an average of 21K workers added for the Census. While the Census Bureau is trying to scale back hiring for its decennial survey, we still anticipate a boost. Altogether, we expect roughly 200K jobs were added in February.

Previous: 225K Wells Fargo: 200K Consensus: 175K

Global Review

Virus Spreads to Broader Global Economy

- A surge in new cases of coronavirus in Italy and Korea led to further concerns over the impact of the outbreak on global growth, while seemingly ongoing disruptions to Chinese economic activity suggest even further downside to our current forecast for Q1 Chinese GDP growth of 5.1% year-over-year.

- Elsewhere, Canada’s Q4 growth figures were soft as GDP barely grew during the quarter, although the details were more mixed. Perhaps the most important global economic data point of the week is still to come, with China’s official PMIs for February due later today, the first significant release from China that should capture the virus’ economic impact.

Virus Spreads to Broader Global Economy

Much of the focus on the global economic front this past week was squarely on the coronavirus, as it spread to more countries and there was a surge in cases in Korea and Italy. Parts of Northern Italy were essentially put on lockdown, while Korea announced a package of temporary fiscal stimulus measures to support economic activity. Reports also indicated that Germany’s government may be willing to relax its stringent “debt brake,” which limits the government’s ability to run budget deficits, potentially opening the door to long-awaited German fiscal stimulus. These announcements highlight that it is fiscal, not monetary, policymakers that seem to be most well-equipped to support global growth amid this virus outbreak. For one, that partly reflects the fact that most central banks have little to no policy space to work with, as nominal policy rates are close to zero or negative in many major economies. More fundamentally, as noted by ECB policymaker Villeroy, the virus is primarily a supply side issue and thus fiscal policy rather than monetary policy is the most appropriate policy prescription.

Despite the market turmoil, it was a reasonably quiet week for global economic data. Canadian GDP data for Q4 were among the more consequential releases of the week. Real GDP rose just 0.3% on a sequential annualized basis, the weakest reading since 2016. That said, consumer demand remained solid, as spending rose 2.0% annualized during the quarter, although business investment dipped 3.1% annualized after a strong Q3. The figures are probably solid enough to keep the Bank of Canada on hold next week, although the coronavirus risk is clearly a wild card.

Mexico also released a fair amount of growth and activity data this week, including updated Q4 GDP data. Revisions to GDP were minimal, other than a slight downgrade to the year-over-year growth rate to show a larger decline of 0.5% in Q4. Importantly, however, the data confirmed that Mexico’s economy contracted 0.1% in full-year 2019, the first annual contraction since 2009. Fortunately, there are some signs of a nascent recovery in Mexico, as retail sales accelerated to 3.2% year-over-year in December, while overall economic activity grew at a 0.7% year-over-year pace during the month, the strongest rate since March 2019. To be sure, the recovery remains fragile and tentative at this point, and the recent coronavirus outbreak is a reason to be cautious on Mexico’s near-term growth prospects. Meanwhile, the central bank has continued to cut interest rates at its recent policy meetings, but the slow pace of those cuts has left policy still fairly tight and not particularly supportive of the recovery at this stage.

Looking ahead to this evening, we are scheduled to receive Chinese PMI data for February, the first look at official economic data that will reflect the impact of the coronavirus outbreak on the economy. The data will be a crucial window into the extent to which China’s economic activity has been affected by the virus, although we note these are only sentiment data and hard activity data will not be available for a few more weeks. In all, however, we see considerable downside risks to our current Q1 Chinese GDP forecast of 5.1% year-over-year as the economy struggles to get back to full capacity.

Global Outlook

Brazil GDP • Wednesday

Brazil’s economy remains sluggish, as real GDP is still nearly 4% below its pre-recession peak in 2014. That said, the details of more recent GDP readings have been more positive, as consumer spending and investment have grown at a healthy clip, while headline GDP has been weighed down by weak exports and declining government spending. Higher frequency activity indicators suggest consumer spending remained generally solid in Q4, although the initial evidence on the investment side is less encouraging.

All in all, Brazil’s economy looks set to continue growing at only a modest pace, as low commodity prices and soft global demand keep a lid on the ongoing recovery. Still, despite lackluster growth, Brazil’s central bank is probably done cutting interest rates for now, largely due to the fact that the Brazilian currency has been so weak in recent months.

Previous: 0.6% Wells Fargo: Consensus: 0.6% (Quarter-over-Quarter)

Bank of Canada Rate Decision • Wednesday

The Bank of Canada (BoC) is expected to hold rates steady at its monetary policy announcement next week, extending a nearly two-year pause in interest rates that has largely been at odds with other global central banks—including of course, the Fed—that have eased policy. That said, the BoC has opened the door to possible easing in its most recent communications and lowered its GDP growth forecasts sharply at the last meeting. At this point, BoC concerns seem mainly growth-driven, as inflation is more or less right on the central bank’s target.

That said, we remain of the view that Canada’s economy is in good enough shape such that the BoC will refrain from easing, even as we recognize the risks of a rate cut have increased. February employment data for Canada are scheduled for release two days after the BoC policy announcement and could nudge the central bank’s stance in either direction at subsequent meetings.

Previous: 1.75% Wells Fargo: 1.75% Consensus: 1.75%

Eurozone Retail Sales • Wednesday

The economic story in the Eurozone very much remains one of divergence, specifically between the manufacturing and services sectors. Despite ongoing weakness in manufacturing, the Eurozone consumer has continued to chug along, underpinned by solid employment and wage growth as well as low inflation. Indeed, retail sales have been buoyant, even if growth has cooled a bit recently, while sentiment in the broader services sector has held fairly steady. Retail sales data for January are due next week and will be a useful gauge of whether the sector remained resilient at the start of the year. That said, now that the number of coronavirus cases in Italy has spiked in recent days, there could be more downside risks for the February figure despite still-solid consumer fundamentals in the broader region. Also due next week are CPI inflation data for the Eurozone, with the core CPI inflation rate expected to tick higher to 1.2% year-over-year.

Previous: 1.3% Consensus: 1.1% (Year-over-Year)

Point of View

Interest Rate Watch

Forcing the Fed’s Hand?

The spread of COVID-19 beyond China has had markets on edge over the past week. In addition to a sharp selloff in equity market, the yield on the 10-year Treasury hit an alltime low this week.

Markets do not expect the Fed to stand by idly amidst the turmoil. Fed futures have fully priced in that the FOMC will cut by 25 bps at its next meeting on March 18, with another 25 bps cut nearly priced in by April.

In recent months, Fed officials have coalesced behind the view that the current stance of policy is likely to remain appropriate unless there is a “material” change to the outlook. Data illustrating any extent of the impact, however, will not be readily available by the March 18 meeting; only a handful of reports will be out through the period covering February.

What would potentially spur the FOMC to cut rates as early as its next meeting then? In our view, the most likely driver of a rate cut on March 18 would be a sustained tightening in financial conditions. Over the course of this week, financial conditions have tightened sharply and are now worse than the tail end of 2018—right before officials adopted a decidedly more dovish tone.

Yet, much remains unknown about the virus and its spread, and the situation could change over the next few weeks. Markets could quickly reprice if the virus’ spread appears more controlled.

Would Easing Even Help?

For the U.S. economy, the most pressing threat appears to be the potential for supply disruptions, something monetary policy cannot influence, rather than a demand shock. Yet Fed easing would not be completely ineffective.

First, lower short-term rates would reduce interest costs for the business sector. That would take some pressure off cash flow and the potential need to lay off workers. Second, lower rates could similarly put some extra cash in consumers’ pockets by spurring another round of refinancing. Third, more accommodative Fed policy would help ease financial conditions, to the benefit of new lending.

Credit Market Insights

Coronavirus Hits Italy

Italian stocks and bonds slipped at the start of the week as the spread of the coronavirus became more intense across Europe and the number of confirmed cases and fatalities in Italy rose significantly. The yield on the Italian 10-year bond initially jumped about 100 bps, while the FTSE MIB index—an index containing 40 of the most liquid and capitalized stocks listed on the Borsa Italiana—fell over 5% on Monday, and was the worst performer among its major European peers. As Italy’s borrowing costs increased and yields on safe-haven German bunds fell, the spread between the closely watched Italian/German 10-year bonds increased nearly 19 bps on Monday, to the widest since January. The widening of the spread is likely a sign of increased risk aversion across European markets, while Italian economic risks may also be playing a role.

Amid the spread of the virus, the government canceled multiple country-wide events and closed many local businesses and schools. In addition, several regions across the country have been on lockdown in an effort to contain the spread. Market participants are now assessing whether the spread of the virus could threaten Italy’s creditworthiness, and have more damaging effects on the Italian economy. Early indications suggest that the surge in infections could tip the Italian economy into a recession, which could also have wider effects on the broader Eurozone. (See Topic of the Week for additional details.)

Topic of the Week

Implications of Coronavirus on the Eurozone

The Eurozone economy has had a rough go of it over the past year or so, as real GDP growth slowed to just 0.9% year-over-year in Q4-2019. To be sure, domestic demand generally held up better throughout much of last year, but we do not have those figures for Q4 yet, and the initial evidence suggests underlying domestic demand took a significant hit in Q4 as well (top chart). Meanwhile, just as the region was digging out from its slowest year of growth since the European Debt Crisis, the coronavirus outbreak has emerged as a significant threat to the Eurozone’s near-term growth prospects. Fortunately, sentiment data were relatively encouraging in the beginning of Q1 and prior to the Italian outbreak, suggesting all is not lost for Eurozone Q1 GDP.

Still, the latest coronavirus developments are likely to significantly disrupt Eurozone economic activity over the next few weeks. The number of cases in Italy has surged in recent days to 650 and has yet to show signs of slowing, while new cases in Spain and Greece are fueling concerns of a broader contagion.

Of course, the effects of coronavirus on the Eurozone economy will largely depend on what happens next. For now, we have 0.2% quarter-over-quarter real GDP growth penciled in for the Eurozone in Q1, which already incorporates the disruptions to Chinese and global demand prior to the recent spike in Italian cases. Recent developments in Italy suggest that Eurozone Q1 real GDP growth could be closer to 0.1% quarter-over-quarter, although we are not making any changes to our forecast at this point. If there is contagion to other core countries such as Germany and/or France, then the risk of an outright decline in Eurozone GDP in Q1 could become a more realistic prospect.

Amid the outbreak, ECB policymakers have generally not signaled any change in its relatively neutral stance and reiterated calls for fiscal stimulus, as they have for several years now. That said, recent reports of German fiscal stimulus have been an encouraging sign, given that Germany in particular has generally signaled a lack of appetite for fiscal stimulus, but it is not guaranteed that authorities will deliver.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals