FOMC Preview – Fed to Deliver Upbeat Message about Economy while Affirming Substantial Progress is Needed to Taper QE

We expect the Fed to turn more upbeat over the economic outlook at this week’s meeting. Yet, the economic improvement is not yet strong enough for any change in the monetary policy measures. As such, the Fed would leave the...

Singapore’s top banks could see a boost in share prices as earnings bounce back

View of the Singapore Central Business District. Suhaimi Abdullah | Getty Images News | Getty Images SINGAPORE — Singapore’s three largest banks are expected to report improved earnings as the global economy recovers from the Covid-19 pandemic, said analysts. ...

Dollar’s Near Term Bearishness Persists, Other Currencies Mixed

Dollar ended as the worst performing one last week as near term bearishness persisted. Q1’s rebound should have completed and the main question is whether it’s ready for new lows. That is, indeed, in favor unless overall risk-off sentiments were...

Weekly Economic & Financial Commentary: Raising the Bar Even Further

U.S. Review: Raising the Bar Even Further This week’s lighter economic calendar allowed forecasters more time to assess the implications from the prior week’s blowout retail sales report. We have revised our forecast for Q1 growth up to a 5.5%...

The Weekly Bottom Line: Big Events Next Week Drive Markets

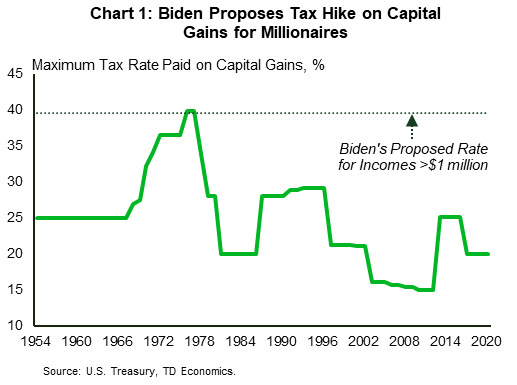

U.S. Highlights Without much noteworthy economic data this week, market sentiment soured on a leaked Biden administration proposal to raise the maximum tax rate on capital gains of high-income taxpayers. First quarter GDP data and a rate announcement from the...

Week Ahead: Central Banks, Coronavirus, Joe Biden and Big Tech Earnings

Heading into the end of April, central banks and earnings will give direction to the markets. The ECB held its ground last week while the BOC chose to taper bond purchases from C$4 billion per week to C$3 billion per...

Week Ahead – Fed to Stay the Course, Huge Earnings Week for Big-Tech, and OPEC+ Meets

Wall Street could see more volatility during a very busy trading week that is filled with a wrath of central bank decisions, surging international COVID-19 cases, solid economic data, effects of stimulus working its way through the economy, and pent-up...

The Fed is unlikely to hint at policy changes next week, even with a stronger economy

Federal Reserve Jerome Powell testifies during a Senate Banking Committee hearing on “The Quarterly CARES Act Report to Congress” on Capitol Hill in Washington, U.S., December 1, 2020. Susan Walsh | Reuters Federal Reserve officials next week are likely to...

FOMC Preview: More Wait and See

The March FOMC meeting was highly anticipated. Bonds yields around the world were rising, as were inflation expectations. However, Fed Chairman Jerome Powell had indicated at the meeting that the rise in yields was due to confidence in the US...

BoJ to Lower Inflation, Raise Growth Projections; Yen Likely to be Unmoved

The Bank of Japan (BoJ) announces the outcome of its April monetary policy meeting on Tuesday and will also publish its latest Outlook Report. Japan is facing a fourth wave of the coronavirus, threatening new state of emergencies being declared...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals