US 30 Index Resumes Bullish Bias; Upside Risks Improve

The US30 stock index (Cash) has currently crept over the all-time high of 33,253 and is headed for the 33,638 level, which happens to be the 261.8% Fibonacci extension of the down leg from 28,900 to 26,065. The sturdy advancing...

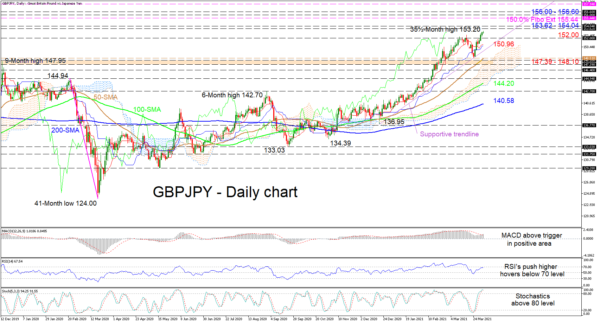

GBPJPY’s Opposing Forces Fail to Oust Bullish Tone

GBPJPY is sustaining its upward trajectory reaching a 35½-month high of 153.20, and bearish powers seem to be incapable of overthrowing the uptrend. The soaring simple moving averages (SMA) are safeguarding the positive structure, while the rising Ichimoku lines are...

XAU/USD Outlook: Gold Extends Recovery But Break Above $1755 Required to Sideline Bears and Signal a Double-Bottom

Spot gold extends strong rebound into second consecutive day after another short-lived probe below psychological $1700 level. The yellow metal advanced over 2.5% in two days, lifted by lower dollar and US and US bond yields, while weak US jobless...

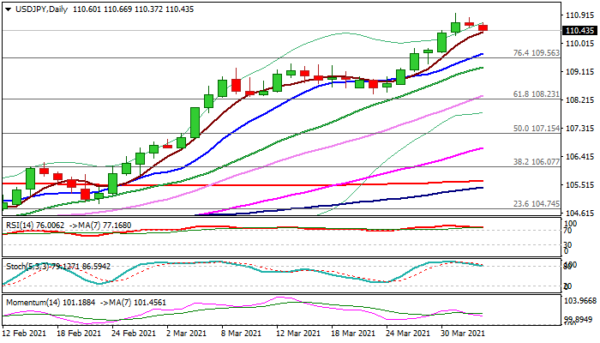

USD/JPY Outlook: Deeper Pullback Expected on Break of 110 Pivot

The pair eases further on Friday following Wednesday’s upside rejection and Thursday’s close in red (the first in seven days) as Japanese traders collected some profits ahead of the weekend. The dollar came under pressure on fresh risk appetite, driven...

WTI Oil Outlook: Oil Prices Jump as OPEC+ Decides to Extend Production Curb for Another Month

WTI oil rose over $2 on Friday and returned above $61 per barrel, lifted by the decision of OPEC+ group to extend production cuts, implemented after oil prices collapsed during the pandemic in 2020, for another month. The world’s top...

USDCAD Loses Steam Around Falling Line

USDCAD is touching the descending trend line after the jump above it in the previous week. The price is returning lower after the pullback off the 1.2645 resistance, remaining within the 20- and 40-day simple moving averages (SMAs). The MACD...

EUR/USD Outlook: Correction Needs to Clear 1.1800 Zone to Resume, US NFP Key Market Driver Today

The Euro is trading within tight range in early Friday, due to holiday-thinned volumes, following a two-day bounce from new multi-month low at 1.1704. Fresh risk mode in the market, driven by signs that US economic recovery (boosted by President...

Chinese electric car start-ups Nio and Xpeng defy first quarter weakness with March surprise

Xpeng CEO He Xiaopeng stands next to the company’s P7 electric sedan as he addresses media at the 2020 Beijing auto show. Evelyn Cheng | CNBC BEIJING — Two of China’s U.S.-listed electric car start-ups beat market expectations in their...

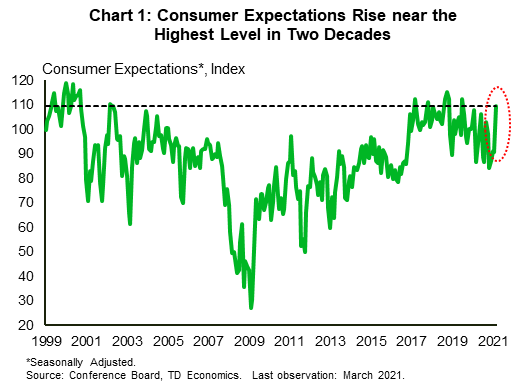

The Weekly Bottom Line: Emerging Markets Are Weathering the Storm

U.S. Highlights Economic data tilted positive this week, with consumer confidence and the ISM manufacturing index rising respectively to one-year and 37-year highs, auguring for a strong showing for Friday’s jobs report. President Biden unveiled a new $2.3 trillion spending...

USD/JPY Surges Above 110.00, Dips Turn Attractive

Key Highlights USD/JPY gained bullish momentum and it cleared the 110.00 resistance. There was a break above two bullish continuation patterns near 108.70 and 109.75 on the 4-hours chart. The US ISM Manufacturing Index increased from 60.8 to 64.7 in...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals