Stocks making the biggest moves midday: Robinhood, EPAM Systems, Kroger and more

Kroger is opening automated warehouses around the country to build a larger and more profitable online grocery business. Kroger Check out the companies making headlines in midday trading Friday. Robinhood — Shares of the trading app dropped more than 7%...

The Weekly Bottom Line: Canada – Rate Hikes Ahead

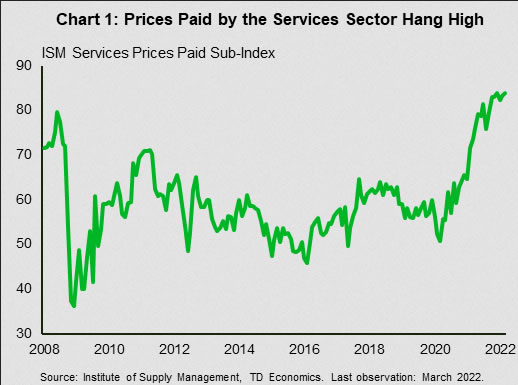

U.S. Highlights The first full week of the second quarter was sparse on economic data. The service sector showed signs of modest acceleration, while vehicle sales declined for the second consecutive month in March. The Federal Open Market Committee (FOMC)...

Bank of Canada to Hike Rates for Second Straight Meeting

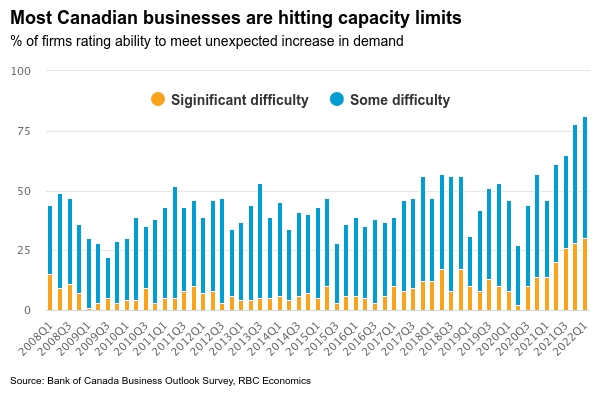

We expect the Bank of Canada to hike interest rates by 50 basis points next week. The move will follow up on the 25 bp rate hike in March and come alongside the widely-expected start of ‘quantitative tightening’ as the...

Week Ahead – Rapid Tightening on the Way

Central banks playing catchup There has been incredible resilience in equity markets in recent weeks as central banks have ramped up interest rate expectations, particularly at the Fed, and bond markets have at times priced in a recession. While there...

Canadian Jobs Data In-line; Full Time Jobs Strong

What makes this number strong is that the amount of full-time jobs was +92,700 vs a loss of 29,300 part-time jobs. With the 1st of April last Friday, Canada waited until the next week (today) to release its March jobs...

NZDUSD Wave Analysis

NZDUSD reversed from resistance zone Likely to fall to support level 0.6830 NZDUSD currency pair recently reversed down from the resistance zone located between the round resistance level 0.7000 and the upper daily Bollinger Band. The pair just broke the...

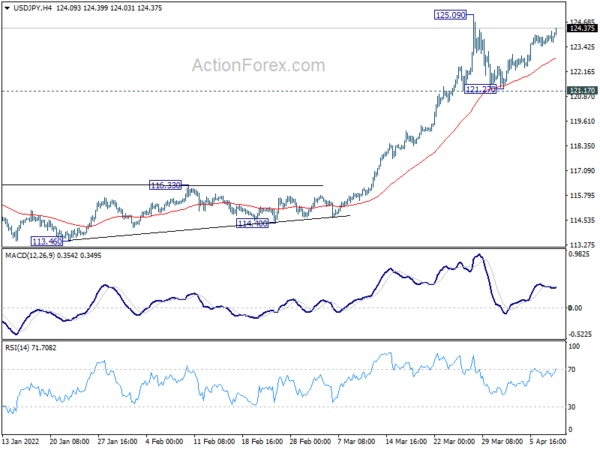

USD/JPY Outlook: Bulls Tighten Grip and Look for Retest of 2022 High

The USDJPY continues to trend higher and extend uninterrupted recovery from a higher base at 121.27 (Mar 30/31) into sixth straight day, on track for the fifth consecutive strong weekly gains. Today’s acceleration cracked pivotal Fibo resistance at 124.19 (76.4%...

Dollar Strong on Rising Yields, Canadian Dollar Rises Slightly after Job Data

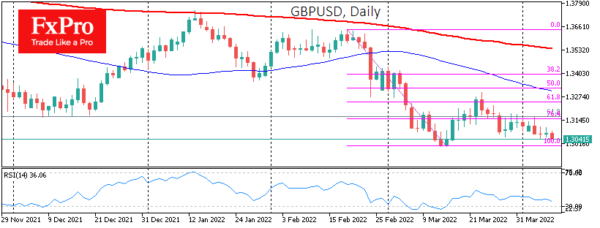

Canadian Dollar rises slightly after solid job data, but Dollar is also firm. The greenback is on track to end as the strongest one for the week, with help from extended rally in treasury yields. On the other hand, Sterling...

Pound Retreats ahead of Dollar; Could Fall to 1.2500

The US dollar works its way up against European currencies, including the British Pound. After a corrective bounce from March 15th to the 23rd, GBPUSD has returned to the downside. Most worryingly, this decline is coming very evenly. It is...

USDCAD Struggles to Surpass 38.2% Fibo Around 1.2600

USDCAD created an impressive bullish rally after the rebound off the 50.0% Fibonacci retracement level of the up leg from 1.2000 to 1.2960 at 1.2485 and is now struggling to surpass the 38.2% Fibonacci of 1.2595 and the 200-day simple...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals