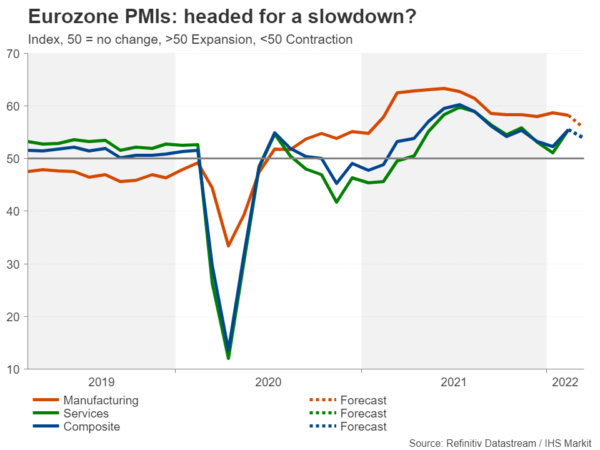

Week Ahead – Flash PMIs to Bring Recession Risks to the Forefront, SNB Meets

The upcoming week will quieten down a bit after what was a busy time for central banks and geopolitical events. But there’s still plenty of activity ahead as the latest flash PMI readings are due and the Swiss National Bank...

EUR/USD Outlook: Negative Fundamentals Weigh Heavily and May Stall the Recovery

The Euro eases on Friday but is on track for the first bullish weekly close in six weeks that adds to positive signals as Doji reversal pattern is forming on weekly chart. On the other side, fresh bulls face difficulties...

GBPJPY Eyes Nearby Ceiling after Extending above MAs

GBPJPY is targeting the 156.77 barrier after maintaining a two-week climb from the 150.96 low, which also managed to overstep the simple moving averages (SMAs). For some time now, the SMAs have been lacking a distinct trend as the pair...

Bitcoin Whale Activity Has Fallen to the Lowest

Bitcoin is down 0.4% over the past 24 hours to $40.7K. Ethereum has added 1.5% over the same time, other leading altcoins from the top ten are changing from -2.0% (Terra) to 5% (Avalanche). The total capitalization of the crypto...

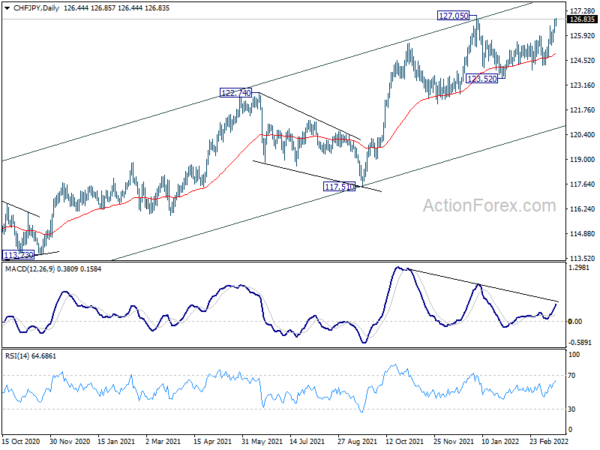

Euro Reverses ahead of Weekend, USD/JPY Resumes Rally

The tide seems to be turning just ahead of the weekend. Swiss Franc is rebounding notably while Dollar is also firmer up. On the other, Euro reverses earlier gain and trades broadly lower. Nevertheless, Yen’s weakness persists and it’s extending...

Elliott Wave View: Gold Rallies Higher After 3 Waves Pullback

Short Term Elliott Wave View in Gold suggests the decline from March 08, 2022 high completed 3 waves down as a zig zag Elliott Wave structure. Down from March 08 wave ((1)) high, wave A ended at 1970.30 and rally...

EUR/USD Pressing Resistance, Yen Continues as Biggest Loser after BoJ

Yen remains the weakest one for the week, following the extended rebound in US stocks overnight, and persistent strength in treasury yields. Swiss Franc and Dollar are also soft as distant second and third. Meanwhile, Euro is currently the best...

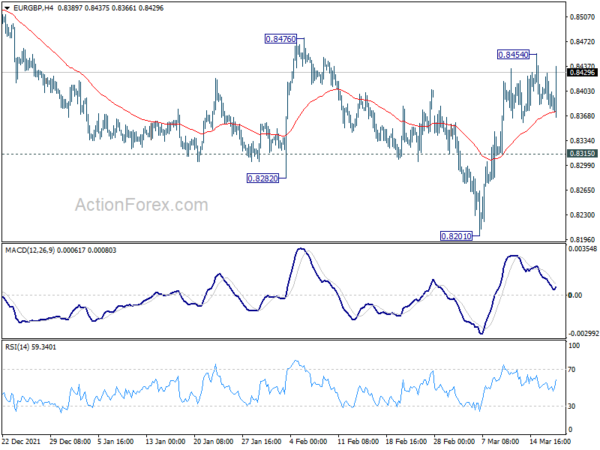

Sterling Dips after Dovish BoE Hike, Euro Mixed

Sterling dips notably after the dovish rate hike by BoE. Yen is following as second worst for the day, then Dollar. On the other hand, Aussie is leading other commodity currencies higher, support by strong job data. Euro is mixed...

WTI Oil Futures Set a Floor, But is it Stable?

WTI oil futures (April delivery) started the day on a positive note on Thursday after two weeks of harsh selling. The positive momentum in the price is following the formation of a bullish doji around 95.32, which seems to have set the...

Dollar Retreats as Fed Hikes for the First Time Since 2018

American stocks rose on Wednesday after signs emerged that Russia and Ukraine were making progress. According to the Financial Times, the two sides have made progress on a tentative 15-point peace plan that includes an immediate ceasefire and withdrawal of...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals