RBNZ Hiked Rate but More Cautious about Economic Outlook

The RBNZ raised the OCR by +25 bps to 0.75%, as we had anticipated. Policymakers sounded more cautiously about the economic outlook while reiterating the stance of continued reduction of stimulus. Kiwi extended recent correction after the announcement. On the...

RBNZ To Lift Policy Rate Again after Strong Inflation

The RBNZ is ready to increase the policy rate again this week. The question is whether, in light of the latest strong inflation data, whether the hike is +25 bps or +50 bps. We continue to expect the former. Several...

Rate Hike Speculations Heighten as Eurozone’s Inflation Accelerates Further

The latest ECB bulletin, European Commission’s latest inflation projections and the preliminary inflation data for October rekindled ECB’s rate hike speculations. At the ECB bulletin, policymakers acknowledged that strong inflation proves more persistent than previously anticipated. Yet, they expected that...

Market Disappointed at BOE Left Bank at Historic Low. Downgraded Growth Forecast

We were surprised that the Committee voted with overwhelming majority to leave the Bank rate at 0.1%. Despite Governor Andrew Bailey’s hawkish comments ahead of the meeting, the was one of those who voted to leave the policy rate unchanged....

Fed Will Start Reducing Asset Purchases in Coming Weeks. Not in a Rush to Raise Rate

As widely anticipated, the Fed announced to taper its QE program. The Fed funds rate was kept unchanged at 0-0.25%. US dollar retreated after the meeting as the Fed continued to view inflation as “transitory” and did not appear to...

RBA Review – Ending Yield Curve Control and Pushed Forward First Rate Hike to 2023

The RBA tilted modestly to the hawkish side by formally ending the yield curve control and adjusting its forward guidance on the first rate hike. Policymakers remained optimistic over the economic outlook and were not very concerned about inflation. Aussie...

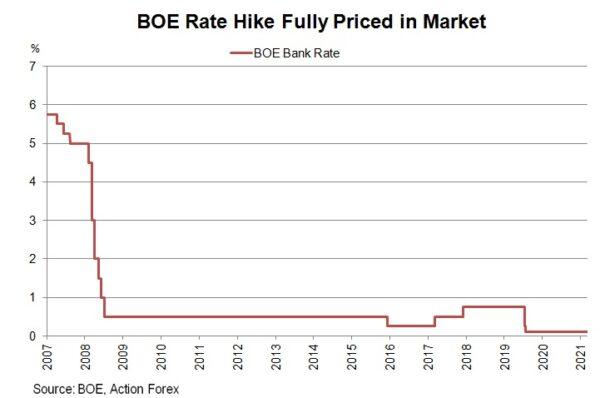

BOE Preview – Rate Hike Cycle to Begin?

The market has fully priced in a +15 bps increase BOE’s bank rate (currently at 0.1%). The mixed economic developments since the September indicate that the Committee will be very divided over whether to hike or to stand on the...

FOMC Preview – Tapering to Formally Being

The November FOMC meeting would see the Fed making a formal announcement on QE tapering. We expect the plan would begin immediately and is expected to end by mid-2022. The Fed funds rate will stay unchanged at 0-0.25%. The market...

ECB Downplayed Urgency of Rate Hike to Tame Inflation

ECB’s meeting came in largely as we had anticipated. Policymakers acknowledged the stronger-than-expected inflation but downplayed the need to push forward rate hike. All monetary policy measures remained intact with the main refi rate, the marginal lending rate and the...

Hawkish BOC Ends QE. May Hike Interest Rate in 2Q22 the Earliest

The BOC surprised to the hawkish side at the October meeting. Policymakers announced to end the QE program and begin the reinvestment process, compared with consensus of a reduction to the weekly purchase of CAD1B. While leaving the overnight rate...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals