‘Bond King’ Jeffrey Gundlach says the Fed shouldn’t raise interest rates this week

DoubleLine Capital founder and CEO Jeffrey Gundlach said Monday that the Federal Reserve should not hike rates at its December meeting later this week. “I think they shouldn’t raise them this week. The bond market is basically saying, ‘Fed you’ve...

Trump advisor Peter Navarro slams the Fed as the biggest risk to US economic growth

White House advisor Peter Navarro — just hours after President Donald Trump blasted the Federal Reserve — doubled down Monday, singling out the central bank as the biggest threat to U.S. economic growth. Appearing on CNBC’s “Squawk on the Street,”...

Trump’s Fed-bashing and interest-rate panic will cause a recession, not prevent one

President Donald Trump’s tweet on Monday morning admonishing the Federal Reserve for even thinking about raising interest rates amplified his recent criticism of Fed Chair Jerome Powell, and just a day before the Fed begins its two-day Federal Open Market...

Americans are more worried about the economy — an ominous sign for Trump’s re-election

More Americans are predicting an economic downturn in the coming year, a shift that could affect President Donald Trump as he seeks re-election. Only 28 percent of Americans think the economy will get better in the next 12 months, according...

Stanley Druckenmiller says Fed must pause because the economy can ‘ill afford a major policy error’

The Federal Reserve should halt its interest rate increases as recent developments in the markets and economy signal caution, hedge fund manager Stanley Drunkenmiller said in a commentary for the the Wall Street Journal over the weekend. “The central bank...

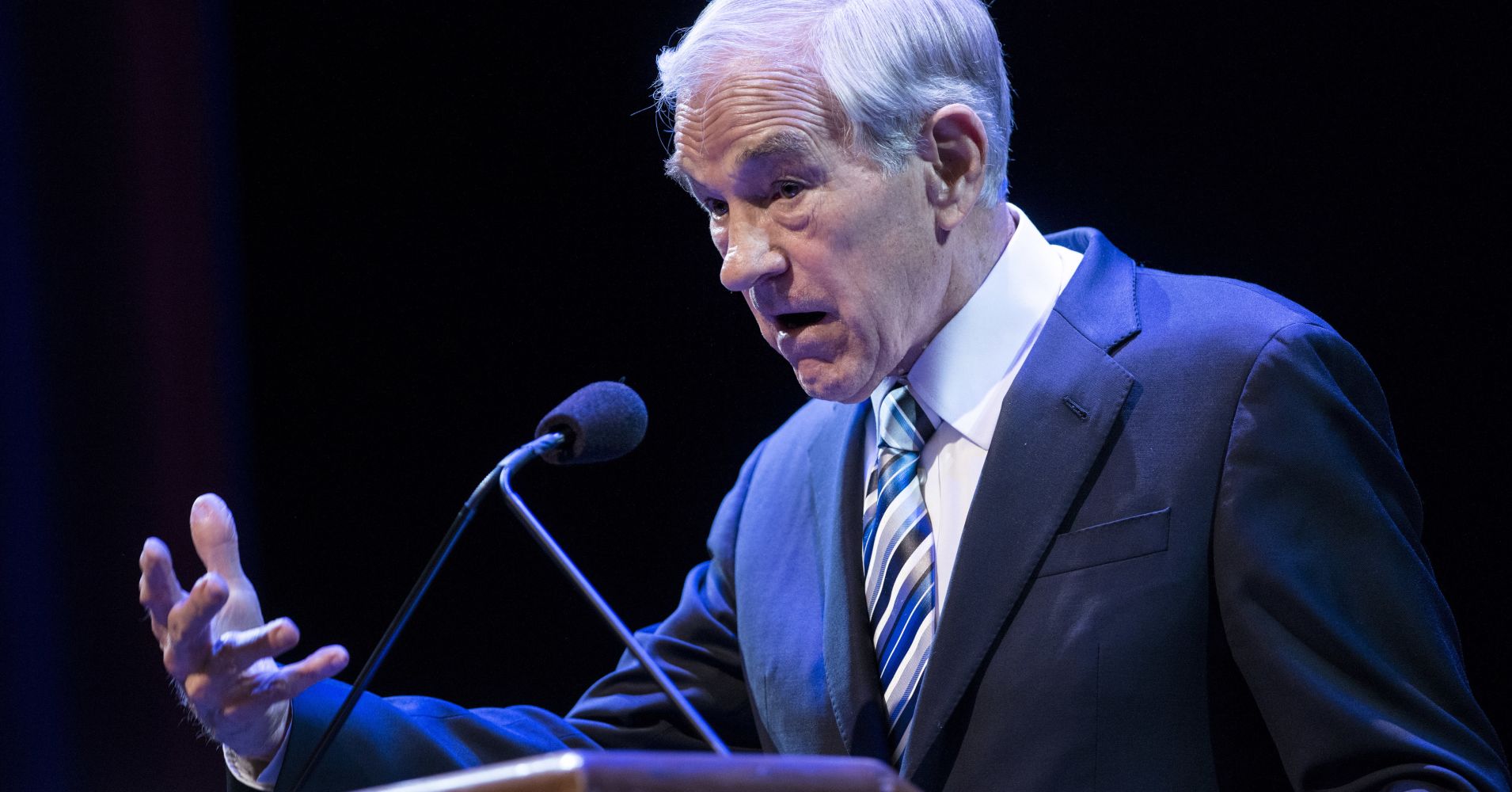

Ron Paul thinks the selloff could spark depression-like conditions that could be ‘worse than 1929’

Ron Paul is warning this year’s corrections could be a precursor to an epic market collapse that may come sooner than investors think. According to the former Republican presidential candidate, Wall Street is becoming more vulnerable to near-depression conditions within...

Federated Investors’ top fund manager thinks the market is wrongly pricing in a 2019 recession

Wall Street angst over a possible recession may be increasing, but one bull refuses to waver. Federated Investors’ Steve Chiavarone believes there’s nothing on the horizon that suggests the 2018 market corrections will become a massive downturn next year. Rather,...

Robinhood takes its 3 percent savings account back to the drawing board amid widespread criticism

Robinhood is going back to the drawing board. Just a day after unveiling what it called checking and savings accounts, the financial technology startup said it is re-launching and re-naming the product, which came under immediate scrutiny from Wall Street...

Fed meeting could be pivotal for stock market looking for ‘knight in shining armor’

The Fed may not be able to turn the tide for the stock market in the week ahead, but it could soothe some of the wild volatility that has been crushing stocks since October. The Fed is expected to raise...

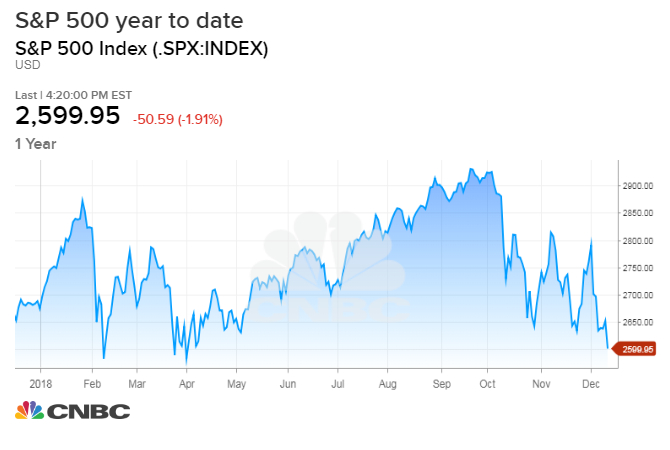

Stocks broke key level and could aim for the year’s low

The S&P 500 could be getting ready to test a new range around the lows of the year that it reached in February — a level that is as much as 3 percent below current levels. The S&P 500 closed...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals