Russia Defaulted on its Foreign Sovereign Debt for the First Time in Over a Century

Markets The short squeeze on bond markets stopped on Friday. US Treasuries underperformed German Bunds during the WS risk rally (+3%). US yields rose by 4 bps (5-yr) to 5.9 bps (30-yr). German yields ended narrowly higher on the day....

Weekly Economic & Financial Commentary: The Housing Market Begins to “Reset”

Summary United States: The Housing Market Begins to “Reset” Fed Chair Powell presented the Federal Reserve’s semiannual Monetary Policy report to Congress this week. In his testimony, he acknowledged that tightening monetary policy in order to reduce inflation may result...

Forward Guidance: Canadian Economic Growth to Lose Steam Over the Summer

Canadian GDP likely continued its upward climb in April. We expect output to have risen 0.3% in the month, slightly more than Statcan’s initial 0.2% estimate a month ago. We look for a similar gain in May. This is despite...

The Weekly Bottom Line: Canada Inflation Rises to 40-Year High

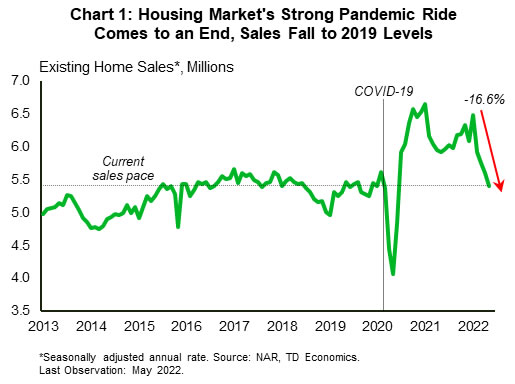

U.S. Highlights Existing home sales fell 3.4% in May, extending the losing streak to four months. The months’ supply of inventory recorded an uptick, rising to 2.6. This was up from 2.2 months in April and 2.5 months in May...

Will Japan’s CPI Inflation Data Move the Yen?

The Bank of Japan has been the black sheep of all central banks, rigidly denying abandoning its ultra-easy monetary policy even if the long-sought inflation pressures have finally showed up in the economy. Investors, however, are less patient than the BoJ, and...

British Pound Yawns as CPI Matches Estimate

UK inflation nudged higher in May, as was expected. The headline release rose to 9.1% YoY, up slightly from the 9.0% gain in April. On a monthly basis, CPI nudged higher to 0.7%, up from 0.6% in April. UK inflation...

Eurozone PMIs: Slowing Down But No Recession Yet

The flash PMI releases by S&P Global are one of the monthly highlights of the Eurozone calendar as the forward-looking indices tend to track GDP growth in the euro area quite closely. The first look at the June readings is...

Key Takeaways from Today’s RBA Communique and What it Means for AUDUSD

Following last week’s mega moves by central banks, the calendar this week allows central bankers to finetune some of those shifts, starting with a plethora of communique from the RBA this morning. The calendar this week allows central bankers to...

Recapping A Swiss Surprise

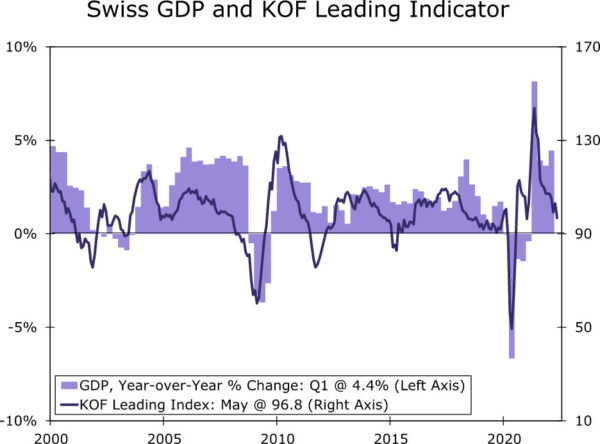

Summary Central banks were in the limelight this week, including the Swiss National Bank (SNB). At its June monetary policy meeting, SNB policymakers opted to raise its policy rate, which was a surprise in terms of timing, and also magnitude...

Week Ahead: Continued Central Bank Fallout; Powell Testimony

If the PMI data this week comes out worse than expected or Powell seems to be leaning “less hawkish”, interest rate expectations may come down. Activity this week should be based on the follow-through from central bank activity last week. ...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals