The Weekly Bottom Line: Fed’s Focus Tilts Squarely on Restoring Price Stability

U.S. Highlights In a carefully crafted speech this week in D.C., Fed Chair Powell reaffirmed the Fed’s keenness for a more aggressive removal of monetary stimulus in order to restore price stability. Powell highlighted the potential for the Fed to...

Week Ahead – An Encouraging Recovery

Are investors correct to be optimistic? Investors appear remarkably calm at the moment given the level of uncertainty we’re facing this year, from inflation to interest rates and even Covid, when you consider China is still embracing lockdowns. Throw soaring...

Weekly Economic & Financial Commentary: Interest Rate Volatility Near a Decade-High

Summary United States: From Factories to Construction Sites, Supply Shortages Slow Activity Economic reports this week for both manufacturing and homebuilding shared two main themes: disappointing headline numbers, but plenty of backlogs for future work. Whether it is new homes...

Weekly Focus – Fed is Stepping Up the Pace

As the conflict in Ukraine remains frozen for now, markets have started shifting their attention also to other topics, especially monetary policy signals. Despite volatile oil prices rising again to USD/bbl 120 after Russia demanded Rouble payments for gas, positive...

Russia to Demand Rubles for Their Oil, Gold Set to Breakout?

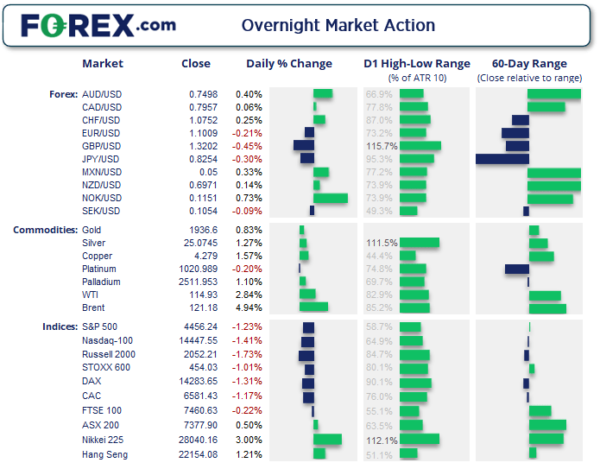

US indices pulled back from their highs overnight as bond yields continued to scream higher as Fed officials maintained their hawkish rhetoric. Wednesday US cash market close: The Dow Jones Industrial fell -448.96 points (-1.29%) to close at 34,358.50 The...

Bitcoin Rises on Capital Flight from Bonds

BTC rose 3.5% on Tuesday. At the peak of the day, the rate exceeded $43.2K, but by Wednesday morning it rolled back to $42K, demonstrating a 0.7% correction. Ethereum is losing 1% over 24 hours, while other leading altcoins from...

Hawkish Powell Roils Markets, Oil Rallies

Asian stocks traded higher this morning while European shares rose after Fed Chair Jerome Powell struck a more hawkish tone on monetary policy. In the currency arena, king dollar received fresh inspiration amid new rate hike bets as the selloff...

NZDUSD Under Pressure as NZ Consumer Confidence Slumps to the Lowest Level Since GFC

U.S. yields surged overnight by a jaw-dropping 10-18bp across the curve after Fed Chair Powell opened the door to a 50bp rate hike at the next FOMC meeting. “if we conclude that it is appropriate to move more aggressively by...

Weekly Economic & Financial Commentary: Significant Monetary Policy Tightening Ahead

Summary United States: Significant Monetary Policy Tightening Ahead In a full week of economic data, Wednesday’s FOMC meeting took center stage. FOMC officials lifted the target range for the federal funds rate by 25 bps. Meanwhile, data on retail sales,...

The Weekly Bottom Line: The Fed Amps Up its Fight Against Inflation

U.S. Highlights The U.S. Federal Reserve raised interest rates for the first time since 2018, and signalled it is prepared to raise rates substantially in order to contain inflation. Oil prices were down this week as renewed lockdowns in China...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals