Australia & New Zealand Weekly: Case for RBA Rate Cuts Continues to Build

Week beginning 18 March 2019 Case for RBA rate cuts continues to build. RBA: Assistant Governor Financial Markets Kent speaks. Australia: AusChamber-Westpac survey, Westpac-MI Leading Index, employment. NZ: GDP, consumer confidence, current account. UK: Meaningful Vote, BOE policy meeting. Europe:...

China Weekly Letter – Xi-Trump Summit Delayed, Q1 Data a Mixed Bag

Xi-Trump summit in April at the earliest, according to sources. Data for Jan/Feb was mixed but leading indicators still point to recovery. Stock markets take a breather as regulator sends warning. Xi-Trump summit delayed to at least April Sources close...

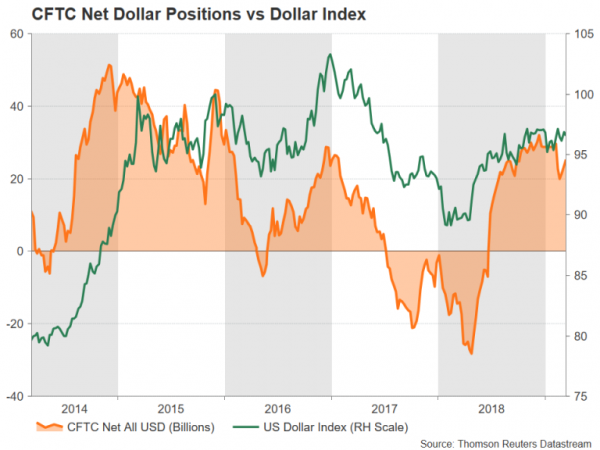

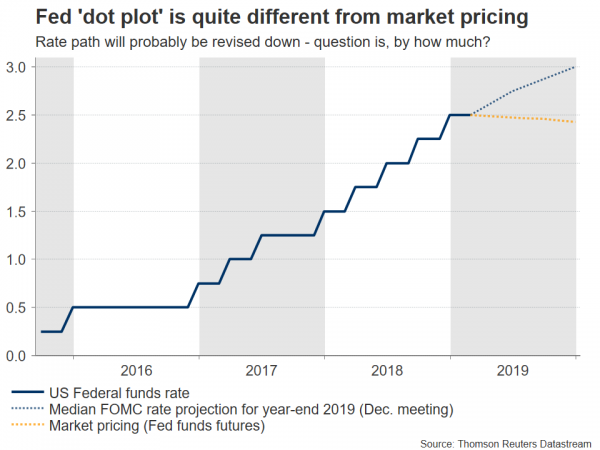

Dollar Depreciation Remains Elusive Even as Fed Prepares to Lower Rate Path Prediction

Following the Federal Reserve’s dovish pivot in January, there is a lot of anticipation for the next FOMC meeting on March 19-20 when policymakers will publish their latest economic projections, including a revised dot plot chart. But as the Fed...

Week ahead – Fed, BoE, and SNB Policy Meetings Highlight a Packed Agenda

Traders will be glued to their screens next week amid a barrage of crucial events, ranging from a highly-anticipated Fed policy meeting to even more Brexit votes in the British Parliament. At the same time, almost every major economy will...

Weekly Focus: Norges Bank to Hike as EU Decides on Brexit Extension

This publication has been prepared by Danske Markets for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents...

Canadian Dollar Rally Fizzles, Manufacturing Production Next

The Canadian dollar is unchanged in the Friday session, after slight losses on Thursday. Early in the North American trade, the pair is trading at 1.3332, down 0.02% on the day. In the U.S., there are two key events. The...

DAX Hits 5-Month High As British Parliament Vote For Brexit Delay

The DAX continues to show strong movement this week, and the volatility has continued on Friday. The index has jumped 1.0% on the day, climbing to its highest level since mid-October. Currently, the DAX is at 11,695. In economic news,...

DAX: Could EU Stocks Catch Up With Wall Street?

As mentioned yesterday, while there are some key risks facing equity market investors, the major stock indices continue to exhibit bullish characteristics for the time being, suggesting more short-term gains could be on the cards. Indeed, despite a flat end...

EUR/USD – Euro Steady As Eurozone Inflation As Expected

EUR/USD has edged higher on Friday, recovering the losses sustained on Thursday. Currently, the pair is trading at 1.1324, up 0.18% on the day. On the release front, the focus is on inflation data. German WPI rebounded after two straight...

It Is Too Quiet

Overall, it has been a relatively quiet week in the FX market, especially under the circumstances. Indeed, the lack of fresh news from the ongoing trade negotiations between the US and China has compelled investors to focus their attention on...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals