Weekly Economic & Financial Commentary: Labor Market Report Complicates FOMC’s Decision on September 21

Summary United States: August Rush Employers added 315K new names to their payrolls in August, but there were an additional 786K people looking for work. Amid such a rush into the labor market, the unemployment rate rose to 3.7%. More...

Week Ahead – Rate Hikes Keep Coming

US The countdown to the September 13 inflation report begins as investors fixate over a wrath of Fed speak, with special attention going towards Chair Powell’s Thursday discussion on monetary policy. It is a slow start to the trading week...

US NFP Close to Expectations. Will it Make a Difference to the Fed?

There doesn’t appear to be anything that would sway the Fed’s rate decision for either a 50bps increase or a 75bps increase at the next meeting. US Non-Farm Payroll for August showed a gain of +315,000 jobs vs an estimate...

The Weekly Bottom Line: Canada – Full Steam Ahead to Hike Rates

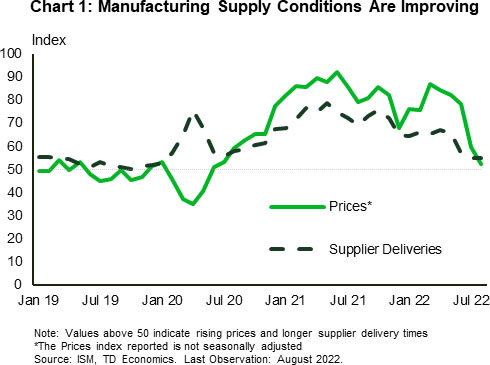

U.S. Highlights A strong week for economic data as the ISM manufacturing index and the payrolls report surprised to the upside. The details of both reports showed improvements on the supply-side of the economy as falling manufacturer input prices and...

Yen Edges Lower as NFP Close to Forecast

It has been a week to forget for the Japanese yen, as USD/JPY has climbed 2.23% and has pushed across the symbolic 140 line. In the North American session, USD/JPY is trading at 140.57, up 0.26% on the day. US...

Australian Retail Sales Post Surprise Bounce

July sales: +1.3%mth (market +0.3%), 16.5%yr. Rate hikes, sentiment slump yet to impact. The ABS preliminary estimates of official retail sales showed a much stronger than expected 1.3% gain in July. That compares to a subdued 0.2% rise in June...

Week ahead: The Last of the “Dog Days of Summer”

Powell ultimately didn’t say anything new, so this week’s price action is likely to shift from a focus on Fedspeak to underlying economic data… Well, that was an ugly end to an otherwise quiet week for risk assets! Equity and...

The Weekly Bottom Line: Powell Stands Firm on Higher Rates

U.S. Highlights Fed Chair Jay Powell’s hawkish remarks at the annual Jackson Hole conference did not sit well with equity markets. The second estimate of Q2 GDP data showed that the economy contracted slightly less, and that GDP grew modestly....

Weekly Economic & Financial Commentary: Powell Delivers Hawkish Message at Jackson Hole

Summary United States: Economy Still Climbing the Mountain The second estimate of Q2 real GDP posted a 0.6% quarterly decline, slightly better than the first-reported 0.7% drop. New home sales fell 12.6% in July, reflecting the ongoing downshift in housing...

Forward Guidance: Canadian GDP Growth Slowing into the Summer

Canadian GDP likely rose in the second quarter—but the trend is unlikely to last. We expect annualized growth jumped to 4.5% from the 3.1% reported in Q1. Spending on services (particularly in the travel and hospitality sectors) surged higher following...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals