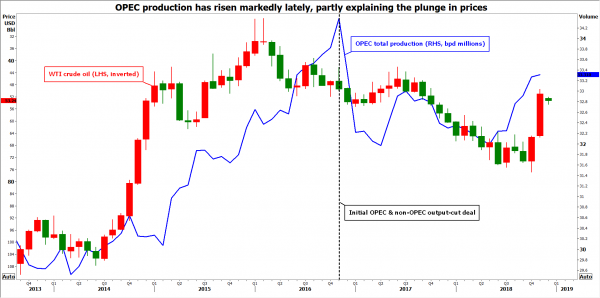

Oil Rebounds Ahead Of OPEC Meeting Amid Hopes For Production Cuts

The Organization of Petroleum Exporting Countries (OPEC) and its allies will meet in Vienna on Thursday, and expectations for a production cut to stabilize oil prices are riding high. With investors appearing confident such a reduction will indeed take place,...

What to Expect From Central Bankers in 2019

Highlights 2019 is likely to represent the peak level of interest rates for the U.S. and Canada. The debate among market participants will continue to heat up on whether central banks will succeed in finding the sweet spot in the...

Japanese Yen Rallies as Risk Appetite Wanes

The Japanese yen has ticked higher in the Tuesday session. In North American trade, USD/JPY is trading at 112.92, down 0.64% on the day. It’s a quiet day on the release front, with no major indicators in Japan or the...

Inverted Yield Curve Curbing Risk Appetite?

Markets back in the red Well that didn’t last long. Day two of the post US/China truce and markets are back in the red and the US yield curve has inverted slightly, potentially taking some of the shine off the...

GBP Currency Gets A Lift From A Non-Binding ECJ Opinion On Article 50

Notes/Observations European Court of justice (ECJ) advisers in a non-binding decision stated that the UK could pull Article 50 unilaterally (Insight: Ruling theoretically meant Britain could cancel Brexit negotiations and stay in EU without asking any of other Member States)...

U.S. Manufacturing Activity Rebounds in November

The Institute for Supply Management (ISM) manufacturing index rose 1.6 percentage points to 59.3 in November. Markets were expecting a tiny tick down to 57.6 from October’s 57.7 value. With the exception of supplier deliveries, which has declined for two...

Trade Wars Armistice Counted Against USD

The currency market started December against the USD. On Monday morning, the major currency pair is trading upwards as investors have no interest in the American currency as a “safe haven” asset. It happened after G20 summit, where the USA...

EUR/USD – Euro Posts Gains As Trump Holds Off On New Chinese Tariffs

EUR/USD has posted gains in the Monday session. Currently, the pair is trading at 1.1347, up 0.25% on the day. On the release front, German and eurozone manufacturing PMIs both missed their estimates, with both indicators posting readings of 51.8...

Markets Rally As President Trump And Xi Call A Truce On Trade

Notes/Observations Asia: Asian Indices trade sharply higher after President Xi and President Trump have agreed that the US will not impose a 25% tariff on Jan 1st, to retain 10% level for 90 days. China agrees to purchase more from...

What’s Next for Italy’s Budget?

Executive Summary Since our most recent special report on Italy, Italian policymakers have continued full steam ahead with their plans to ease fiscal policy next year through a combination of tax cuts and increased spending. Over the past eight weeks,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals