Week Ahead: When “Transitory” is No Longer “Transitory”, RBA, BOC, and Omicron

US Fed Chairman Jerome Powell testified last week in front of the Senate and Banking Committee that he is retiring the word “transitory”. This should have sent shivers through the market. However, the shivers felt may have been from something...

Week Ahead – Volatility to Remain

Omicron and central banks to dominate The past week has been dominated by Omicron news as we all try to piece together the limited information we have and determine what it all means for the coming months. So much is...

Week Ahead – US Inflation to Fire Up Again, Watch Out Fed

Riskier assets have been under pressure ever since Omicron entered the equation, fearful that central banks cannot ride to the rescue this time because inflation is so hot already. This puts even more emphasis on the next edition of US...

US Labour Market Recovery Inched Forward in November

Payroll employment added 210k jobs in November, disappointing expectations Unemployment rate ticked lower to 4.2%, closer to rate pre-pandemic Inadequate labour supply adding pressure to wage growth Payroll employment rose by 210k in November in the US, disappointing consensus expectations...

Cliff Notes: Australia Shows Resilience as US FOMC Focus Attention on Inflation Risks

Key insights from the week that was. Q3 GDP was centre stage in Australia this week. In all respects, the outcome was well ahead of expectations. In the lead-up to the release, the scale of the anticipated contraction was reduced...

British Pound Edges Higher

The British pound has edged upwards and punched above the 1.33 line. In North American trade, GBP/USD is currently trading at 1.3319, up 0.34% on the day. It has been a light calendar for tier-1 events out of the UK. Truth...

Fed Chair Powell’s U-Turn On Inflation Is The Obvious Driver

Markets European stocks recovered in absence of any Omicron-related headlines. Main equity indices gained up to nearly 3% for the EuroStoxx50 in a calm European trading session. Core bonds and EUR/USD treaded water. Dynamics again changed during US dealings. A...

CAD Shrugs as Building Permits Sparkles

The Canadian dollar has edged lower on Wednesday. In North American trade, USD/CAD is trading at 1.2743, down 0.27% on the day. Canada’s Building Permits beats expectations It has been a relatively quiet week for the Canadian dollar, despite some...

The US Federal Reserve Can Fully Complete The QE Program At The Next Meeting

Fed chief Jerome Powell indicated in his speech to the US Senate that the US central bank could fully reduce large-scale bond purchases in two weeks, referring to a strong economy. This will be a necessary first step toward raising...

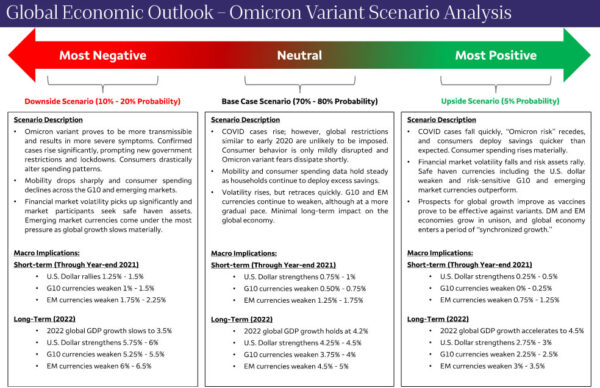

Omicron Introduces New Risks For Global Economy

Summary The recently detected Omicron COVID variant has injected new risks into the global economy. In this report, we lay out our base case scenario for the global economy and currency markets amid the early onset of Omicron cases. We...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals