China Unlikely to Give In to Trump’s Demands Despite New Tariffs

Trump is expected to implement the second round of tariffs on an additional USD200bn of imported goods from China either later today or tomorrow. Trump’s purpose seems to be to put China under pressure, forcing them to give in to...

Yield Outlook: Italy Moving to the Background and Fed Hikes to Continue

The focal point in the European bond markets over the summer has been Italy. This has resulted in downward pressure on, in particular, German yields and in August the 10Y bund yield was as low as 0.30%. Simultaneously, the yield...

Another 200 Billion In Tariffs Looks More Likely Than Not

Another 200 billion in tariffs looks more likely than not. Happy to hear that markets in Hong Kong are expected to start trading on Monday after Mangkhut roared through the City. But more significantly friends and colleagues are all safe!!...

Weekly Economic and Financial Commentary: US Growth Remains on Track

U.S. Review Growth Remains On Pace With Little Sign of Overheating The inflation data took center stage this week. The CPI and PPI both came in slightly below expectations and inflation expectations remain well anchored. Import prices also fell more...

The Weekly Bottom Line: Rising Rates Eating Into Household Incomes

U.S. Highlights Foreign central banks took center stage this week. The Central Bank of Turkey raised its policy rate to 24% from 17.75% in the hope of retaining and attracting new foreign capital. The ECB confirmed it will taper its...

USD/CHF Oscillating Around 0.9700 Ahead of Next Week’s SNB Meeting

Political headlines and trade fears are dominating the headlines in today’s North American session, leading to a slight risk-off tone despite a positive open for risk assets. As a result, we’ve seen the US dollar, Japanese yen, and Swiss franc...

Gold Undermined, Dollar Underpinned as US 10y Yield Hits 3pc

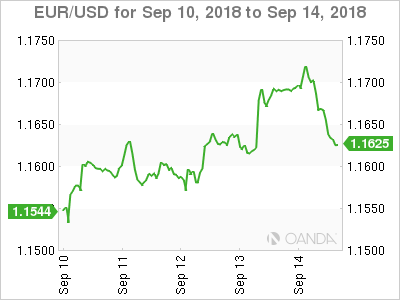

This week has been a mixed one for the dollar, and by extension gold. Sentiment towards the greenback turned slightly negative in mid-week following the release of some weaker-than-expected US inflation figures. A rebound for the euro and pound, and...

Trade Tensions Return as US Tariffs on China Lift Dollar

The dollar bounced back on Friday, after a couple of economic indicator misses this week, the greenback is higher against all major pairs. Major pairs and commodities are lower against the greenback ahead of the weekend. The American currency did...

Is the US Economy Running Out of Labour?

Key points Tight US labour market a rising risk to growth. US-China trade war set to escalate further before deal is reached. Emerging market assets cheaper but still short-term risks. Tight labour market a rising challenge to US growth The...

Week Ahead – Inflation and flash PMI data to dominate; BoJ to leave policy unchanged

Economic data will move to the fore next week with several countries reporting inflation, retail sales and flash PMIs. Canada and the United Kingdom will publish CPI and retail sales figures, while in the Eurozone, the focus will be on...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals