A Complex Matrix Of Confusion

A complex matrix of confusion. Establishing views on cross assets classes on Monday morning is becoming increasingly difficult. The tricky environment I am looking at today – advertisement –

Emerging market issues are still lingering and incredibly shaky outlook,...

Weekly Economic and Financial Commentary: Economy Appears Solid Despite Trade Tensions

U.S. Review Economy Appears Solid Despite Trade Tensions Despite ongoing concerns surrounding trade policy, business activity reportedly picked up in August. The ISM manufacturing and non-manufacturing indices both advanced, increasing to 61.3 and 58.5, respectively. Employers added 201,000 new jobs...

The Weekly Bottom Line: Summer’s Ending, But the U.S. Economy Still Shines

U.S. Highlights Concerns about emerging markets continued to weigh on investor sentiment this week, with the selloff in EM assets and currencies spreading beyond Turkey and Argentina. Meanwhile, domestic data remained positive. ISM indices for both manufacturing and services sectors...

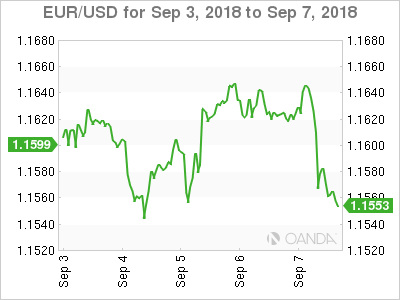

Trade Tensions and Strong US Employment Lift Dollar

The US dollar rose on Friday against all major pairs after a strong U.S. non farm payrolls (NFP) report was published. The US added 201,000 jobs, but more importantly hourly wages beat expectations in August coming in at 0.4 percent....

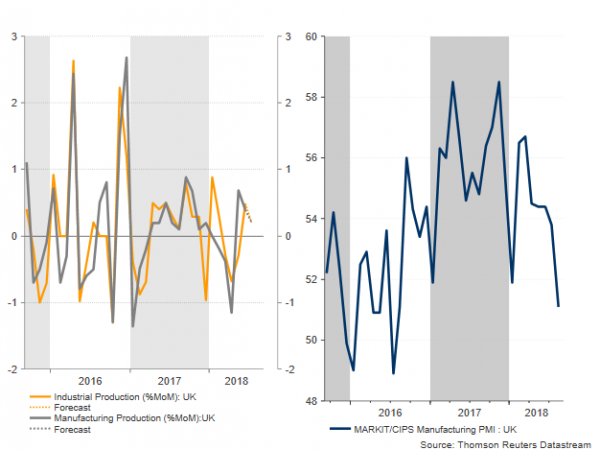

UK Manufacturers to See a Slowdown; UK GDP Growth to Inch Up in July

Early this week the IHS/Markit Institute indicated that the British manufacturing industry had slowed down to its lowest expansion rate since July 2016 – July 2016 was just after the Brexit referendum – as the country’s export business contracted for the first time...

Trump is Struggling With Only Two Months to Midterm

Today’s key points US midterm election is mostly a political event not an economic event. We expect the market implications to be limited, as Trumponomics is unlikely to be rolled back. In Europe, there are early signs that soft indicators...

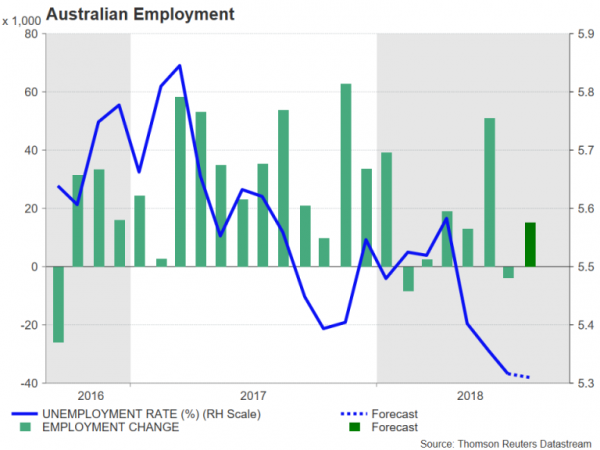

Australia & New Zealand Weekly: We Still Expect a Growth Slowdown in 2019 Despite Recent Strong GDP Report

Week beginning 10 September 2018 We still expect a growth slowdown in 2019 despite recent strong GDP report. Australia: Westpac-MI consumer sentiment, Westpac-AusChamber survey, employment, RBA Assistant Governor Bullock speaks. NZ: retail card spending, house sales and prices. China: fixed...

Week Ahead – ECB and BoE Meet But No Fireworks Expected; China Data, Aussie Jobs and US Inflation Eyed Too

Monetary policy will be back in focus next week as the European Central Bank and the Bank of England hold policy meetings. However, with both central banks expected to stick to their existing outlook, investors will likely turn to data...

Weekly Focus: Will Trump Step Up the Trade War?

Market Movers ahead US President Trump to possibly announce US tariffs on an additional USD200bn of Chinese imports next week. Also CPI data will be released (Thu), where we expect 2.3% Emerging markets will continue to be in focus, in...

US: Wages Picking Up as Labor Market Tightens

Employers added 201,000 jobs in August. That marked an improvement versus July, but the overall trend in hiring is slowing as employers are increasingly having trouble finding workers. Wages are rising as a result. Slower Job Growth but Wages Pick...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals