U.S. August Employment Bounces Back

Highlights: August payroll employment bounced back to 201k following downwardly revised gains in July of 147k (157k previously) and in June of 208k (248k). Market expectations had been for a 193k increase. The increase in employment was skewed towards private...

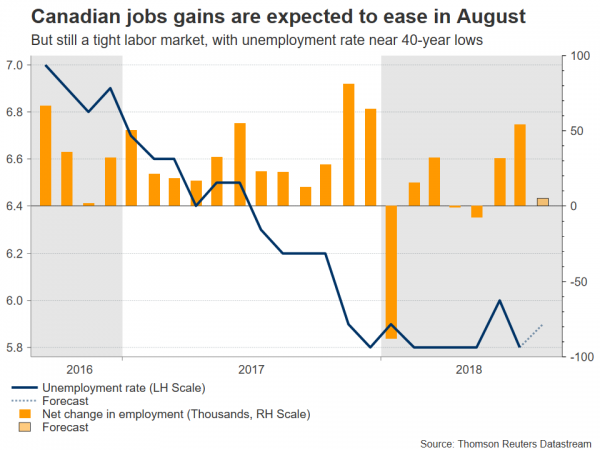

Canadian Labour Market Improvement Took a Breather in August

Highlights: Employment fell 52k in August to retrace most of a 54k increase in July. Sectors of strength in July (like education hiring) were generally not areas of weakness in August. The unemployment rate ticked up to 6.0% from the...

Non-Farm Payroll (NFP) Preview

September has started with a bang with emerging market currencies, commodities and stocks all selling off. More fireworks could be on the way as we head to the final day of the week with jobs data from both North American...

Why Don’t You, Show Me The Way?

Why don’t you, show me the way? EM’s weakest links continued to firm yesterday on a combination of profit taking and position squaring ahead of today major risk events with the beleaguered ARS leading the pack ringing in close to...

Canadian Jobs Data Due as Loonie Wrestles with NAFTA Worries

Employment data out of Canada will be made public on Friday at 1230 GMT, with forecasts pointing to a cooling in the labor market during August. If so, that could cast further doubts on expectations for a BoC rate increase...

XAUUSD Outlook: Gold Maintains Firm Tone; Stronger Rally on Trade Concerns/Emerging Mkts Crisis Not Ruled Out

Spot Gold benefited from weaker dollar on Thursday and extends recovery from $1189 (04 Sep low) into second day. Fresh bullish acceleration broke above psychological $1200 barrier, reinforced by 10SMA and probed above $1204 pivot (Fibo 61.8% of $1214/$1189 bear-leg)....

Lather Rinse Repeat

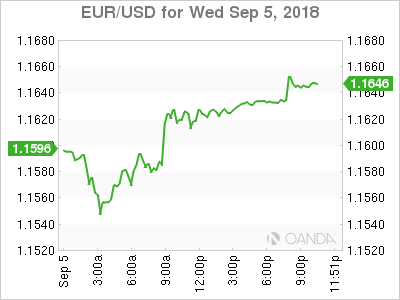

Lather Rinse Repeat The markets are going through what feels like an endless loop of lather, rinse and repeat when it comes to the US dollar. But while there was lots of noise on Wednesday traders are lacking a definitive...

Dollar Loses Momentum Ahead Of Private Payrolls

The US dollar is lower against major pairs on Wednesday. Advances in the US-Canada and Brexit negotiations eased fears of further tensions. American and Canadian negotiators restarted the NAFTA renegotiation talks today. Both parties remain optimistic on a positive outcome,...

BoC: A Gold, With a Hike Likely Just Around the Corner

The Bank of Canada held its key monetary policy interest rate at 1.50%, meeting market and economists’ expectations. The statement accompanying the announcement struck a slightly hawkish note, indicating that the next rate hike will be coming soon. The economy...

BoC Keeps Rates on Hold at 1.5%, CAD Falls

No surprise, the Bank of Canada (BoC) has kept its overnight rate steady at +1.5%. The bank warned that heightened trade tensions represent a key risk to the global outlook. In the accompanying communiqué, the central bank reiterated its view...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals