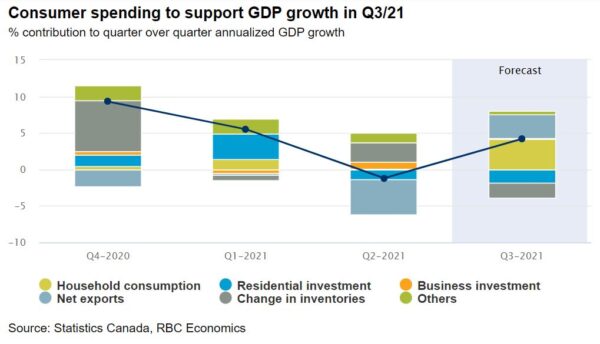

Canadian Economy Rebounds in the Third Quarter

Real GDP rose by 5.4% (annualized) in the third quarter, above the consensus call for 3.3%. This left economic output 1.4% below its pre-pandemic (2019-Q4) level. In nominal terms, GDP increased by 8.9% in the third quarter. Statistics Canada also...

Asian Open: Equities Rise – Cautious Optimism Or Dead Cat Bounce?

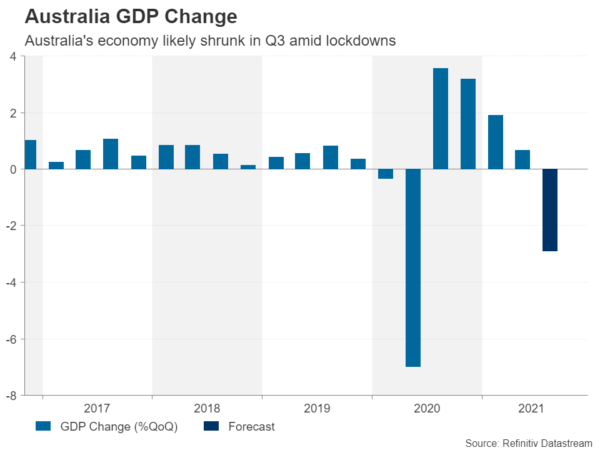

Asian Futures: Australia’s ASX 200 futures are up 41 points (0.57%), the cash market is currently estimated to open at 7,280.80 Japan’s Nikkei 225 futures are up 140 points (0.5%), the cash market is currently estimated to open at 28,423.92...

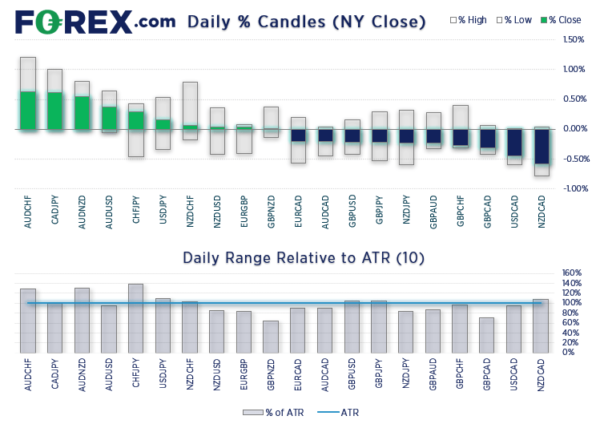

Resilient Dollar Rebounds and Markets Calm

Greenback shrugs off new virus scare, market sentiment bounces back The calmer markets today seem to have brushed off the shock linked to the new omicron variant that plunged global equity markets on Friday. Despite markets rapidly regaining their composure,...

Say Hi To Omicron

Omicron wreaked havoc in the markets on Friday, sending European indices near 5% lower into Friday’s close. The selloff in the US was a bit less severe, but this is obviously not the performance we were expecting on Black Friday....

Week Ahead: Who Cares about Inflation When There is an Omicron Covid Variant?

“Early indications show this variant may be more transmittable than the Delta variant, and current vaccines may be less effective against it”. Last week began with worries about inflation and concerns that the Fed would taper more quickly than Powell...

The Weekly Bottom Line: Consumer Spending Powers Ahead

U.S. Highlights President Biden removed months of speculation by announcing his nomination of current Fed Chair Jerome Powell for a second term to head the Central Bank. He will be joined by Governor Brainard who the President nominated for Vice-Chair....

Forward Guidance: Canadian GDP Edging Higher as Labour Markets Tighten

We expect GDP rose 4.0% (annualized) in the third quarter, picking up after a 1.1% decline in Q2 when COVID-19 restrictions were more stringent. That Q3 increase would be stronger than the 2% early estimate from Statistics Canada a month...

Week Ahead – Pressure Mounting on Central Banks

Investors concerned about new Covid variant For months now the main topic of conversation in the markets has been inflation. Is there too much of it, is it here to stay, and are monetary policymakers actually going to do something...

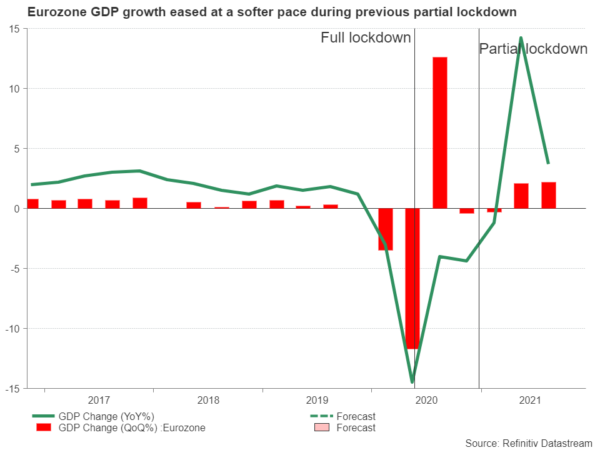

Eurozone’s Inflation Spiral to Continue but will Euro Capitalize?

The euro went downhill lately as Europe became the epicenter of another pandemic wave, forcing several economies to return to lockdowns ahead of the holiday season. With new business containment measures rolling in, investors are wondering whether inflation will continue...

Week Ahead – NFP Report Could Keep the Dollar Rally Going

It will be hard for the US dollar to escape the spotlight in the coming week as the November jobs report will likely further fuel expectations of faster Fed tapering, extending the rally. The last month of the year is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals