RBA Will Not Extend YCT and Will Move to More Flexible QE Model

Introduction The RBA Board is likely to decide that there will be no extension of the YCT to the November 2024 bond at the July Board meeting because such action would imply no tightening till 2025. Westpac disagrees with that...

A Booming Economy, Soaring Commodity Prices, So Why is the Aussie Not Rallying?

The Australian dollar made a spectacular rebound from the March 2020 nosedive against the US dollar. But although Australia’s economic recovery has gone from strength to strength, the rally has stalled since March this year. There are a number of...

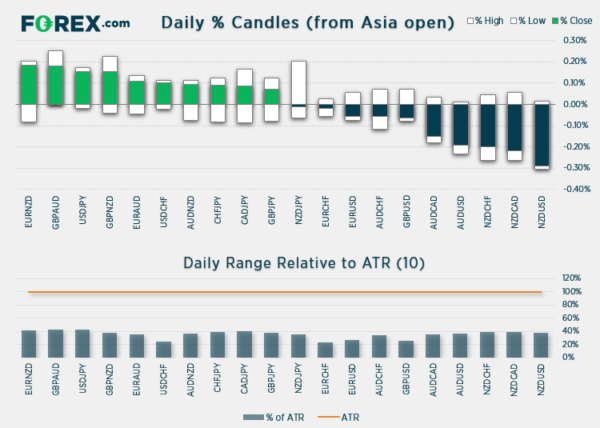

European Open: FTSE Breaks 7100, Employment And ISM In Focus

So far, so good, where Tuesday’s bullish breakout on the FTSE is concerned. And equities were a touch higher overnight ahead of key US data later today. Asian Indices: Australia’s ASX 200 index rose by 46.3 points (0.64%) and currently...

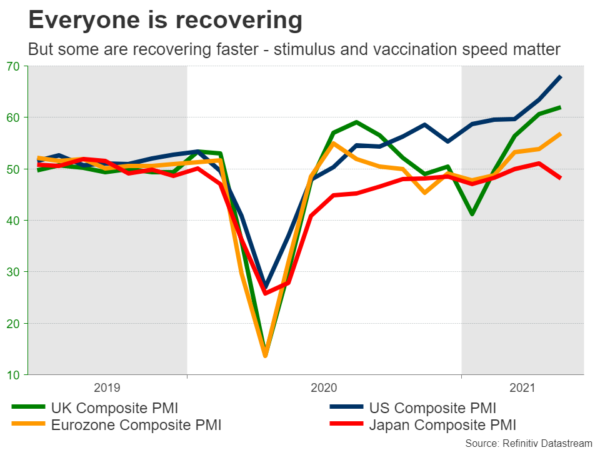

With Central Banks Stepping Back, the Yen Looks Fragile

Central banks across the world are starting to step back from the ultra-loose policies they enacted last year, as widespread vaccinations and government spending do the heavy lifting. We are still in the early stages of this process, but the...

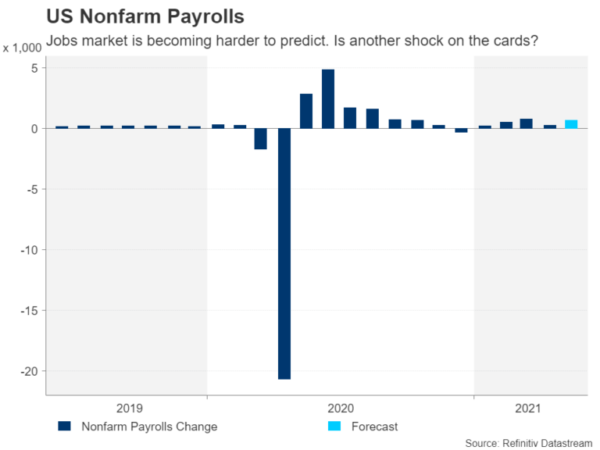

NFP: US Jobs Recovery To Get Back On Track But Will It Be Enough For The Fed?

Markets are still reeling from the April jobs report as the massive shortfall from the estimates killed any expectations that the Fed would begin tapering in the summer. The May report is not anticipated to be as much of a...

Pound Dips Despite Strong Manufacturing PMI

The British pound has reversed directions on Tuesday. The pair is currently trading at 1.4173, down 0.29% on the day. On the fundamental front, UK Manufacturing PMI accelerated for a fourth straight month. The PMI surged in May, rising from...

Canadian Dollar Rises Ahead Of GDP

The Canadian dollar continues to drift this week. In the European session, USD/CAD is trading at 1.2037, down 0.08% on the day. Canada GDP projected to accelerate Canada’s economy is expected to have surged ahead in the first quarter of...

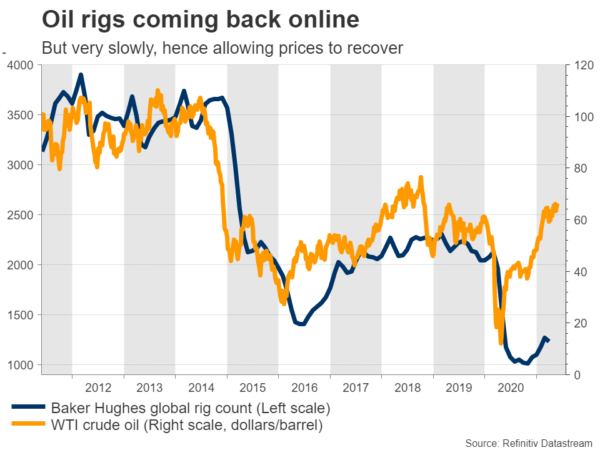

OPEC Meeting Unlikely to Roil Markets, But Iran Might

It’s a crucial week for the oil market, with an OPEC+ meeting on Tuesday that will likely see the cartel and its allies increase their production gradually, capitalizing on the improvement in demand. This has already been decided, so the...

Will Canada GDP Lift Canadian Dollar?

The Canadian dollar is almost unchanged at the start of the week. In the European session, USD/CAD is trading at 1.2064, down 0.06% on the day. US markets are closed for Memorial Day and there are no US events, so...

Asian Manufacturing Disappoints Slightly

Market movers today Key market movers this week will be US non-farm payrolls, ISM manufacturing, and euro Flash CPI, see Weekly Focus, 28 May, for more. Talks on a US infrastructure bill are also set to continue this week. Speeches...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals